Last May, I announced my intention to create a portfolio that embodied life's basic needs. To that end, over a period of 10 weeks, I detailed 10 diverse companies that I think will outperform the broad-based S&P 500 over a three-year period because of their ability to outperform in both bull markets and bear markets, as well as their incredible pricing power in nearly any economic environment.

If you'd like a closer look at my reasoning behind each selection, just click on any, or all, of the following portfolio components:

Let's look at how our portfolio of basic-needs stocks has fared since we began this experiment.

|

Company

|

Cost Basis

|

Shares

|

Total Value

|

Return

|

|---|

|

Waste Management

|

$42.60

|

23.24

|

$1,039.06

|

5%

|

|

Intel

|

$23.22

|

42.64

|

$1,327.81

|

34.1%

|

|

NextEra Energy

|

$87.94

|

11.26

|

$1,105.96

|

11.7%

|

|

MasterCard

|

$64.557

|

15.30

|

$1,174.12

|

18.9%

|

|

Chevron

|

$124.95

|

7.93

|

$1,040.34

|

5%

|

|

Select Medical

|

$8.96

|

110.49

|

$1,736.90

|

75.4%

|

|

Ford

|

$17.50

|

56.57

|

$979.79

|

(1%)

|

|

American Water Works

|

$43.13

|

22.96

|

$1,103.46

|

11.4%

|

|

Procter & Gamble

|

$81.29

|

12.18

|

$974.16

|

(1.6%)

|

|

AvalonBay Communities

|

$133.95

|

7.39

|

$1,049.60

|

6%

|

|

Cash

|

|

|

$0.88

|

|

|

Dividends receivable

|

|

|

$277.03

|

|

|

Total commission

|

|

|

($100.00)

|

|

|

Original Investment

|

|

|

$10,000.00

|

|

|

|

|

|

|

|

|

S&P 500 performance

|

|

|

|

16.1%

|

|

Performance relative to S&P 500

|

|

|

|

2%

|

Source: Yahoo! Finance, author's calculations.

The Basic Needs portfolio may not have kept up with the benchmark S&P 500 this past week, but I'm nonetheless impressed by its outperformance over the past 11 months and the nearly 3% yield it has delivered. Compounded over time, these dividends are the differentiating factor that can help investors handily trounce the market.

Normally we would jump right into dividend news, but with none of our stocks announcing payouts, going ex-dividend, or paying dividends this past week, we'll instead focus on five news events that could affect individual companies within this portfolio.

Ford downshifts

Ford shareholders have had an incredible run since the recession, but they needed to downshift their expectations for domestic growth last week after the company reported a 6% decline in year-over-year U.S. vehicle sales for June. Overall, fleet sales dipped 7% while retail sales fell 5%. The big positive for the month included the best-ever June for the Fusion, but the month also saw F-Series sales dip by 11% and Fiesta sales plummet by 31%.

![]()

Source: Ford.

I would suggest not getting too worked up over this decline as of yet considering that it is just a single month. Then again, the fact that Ford's domestic sales are down 1.8% year to date has to be sitting poorly with some investors. Thankfully, strong growth in China and India, as well as a strength in the automaker's commercial vehicle segment in Europe, is more than canceling out domestic weakness.

Select Medical buddies up

Proving that sometimes smaller companies can indeed be the biggest winners, outpatient rehabilitation and hospital provider Select Medical announced a joint venture with Emory Healthcare in Georgia to provide rehabilitative care to patients. Under the terms of the joint venture, Emory Healthcare will be the majority owner of most of the existing facilities, but Select Medical will step in and manage these hospitals. As noted by the press release, Select Medical will also be the majority owner of three long-term acute care hospitals in the greater Atlanta area.

This type of collaboration is incredibly important in enabling a smaller medical-care provider like Select Medical to expand its geographic reach while also keeping its costs under control. Prior to the implementation of the Affordable Care Act, known better as Obamacare, Select Medical had been tightening its belt. We're beginning to see those operational efficiency improvements through its latest results. Couple this collaboration and cost-cutting with the expectation of fewer uninsured and underinsured patients being treated, and the bullish case for Select Medical keeps growing.

Chevron gets the OK to expand

Just in case you thought vertically integrated oil and gas giant Chevron wasn't big enough already, on June 30 it and joint-venture partner Phillips 66 announced that they had received the appropriate environmental permits from the Texas Commission on Environmental Quality to expand normal alpha olefins production at their Cedar Bayou plant. According to their press release, the plant expansion will add 100,000 metric tons per year of capacity and construction should be done one year from now. The move is necessitated by increased demand for normal alpha olefins, which are used in products such a motor oil.

![]()

Source: Rongy Benjamin, Flickr.

Although this approval isn't going to cause Chevron's top or bottom line to soar, it's another piece of the puzzle that demonstrates Chevron's diversity. Despite an early year swoon, higher oil prices appear to have Chevron back on track, which makes its 3.2% yield look even that much more appealing.

MasterCard and bitcoin: say what?

As reported by Forbes on June 30, MasterCard has filed for a patent entitled "Payment Interchange for Use With Global Shopping Cart" that could enable it to act as the intermediary in transactions involving bitcoins. The Internal Revenue Service ruled in 2013 that bitcoins are property, so in bartering-type situations MasterCard could net itself a transaction fee when bitcoin is available to be used.

The U.S. Patent and Trademark Office hasn't granted MasterCard its patent yet, but this, too, demonstrates just how far-reaching the company's presence could go if it is approved. Many consumers, myself included, are still somewhat in the dark when it comes to what bitcoin will ultimately be used for, so for now I wouldn't factor this into MasterCard's valuation much, if at all. However, I would suggest keeping an eye on this possible patent as it could be worthwhile for MasterCard over the long run.

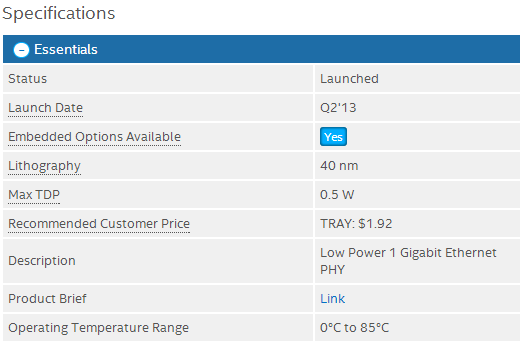

Intel notches a key smartphone win

Lastly, it's been perhaps the only area where Intel's beefed-up research and development spending hasn't yielded solid results, but the chipmaker announced that Samsung had chosen its first-generation multimode XMM 7160 LTE modem for its Galaxy S5 Mini.

![]()

Source: Intel Free Press, Flickr.

As Foolish technology specialist Ashraf Eassa noted this past week, this is the kind of win that could make Intel the No. 2 player in cellular technologies for smartphones, behind only Qualcomm. A single product win, though, doesn't make Intel's smartphone hardware segment a success. It will need consistent wins here, just as in its data center, tablet processing, and PC processing segments, if it hopes to grow its top and bottom line.

Dividends are the secret to a great portfolio. Read about the latest high-yielding stocks to grab the attention of our top analysts!

The smartest investors know that dividend stocks simply crush their non-dividend paying counterparts over the long term. That's beyond dispute. They also know that a well-constructed dividend portfolio creates wealth steadily, while still allowing you to sleep like a baby. Knowing how valuable such a portfolio might be, our top analysts put together a report on a group of high-yielding stocks that should be in any income investor's portfolio. To see our free report on these stocks, just click here now.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.