Filed under: Investing

Supply and demand are what typically fuel oil prices. However, market fundamentals aren't the only factors at play. Speculators, like hedge funds and other big money investors, play a role in the price of oil as well. They can push it up past market fundamentals or, as they have recently, cause it to plunge -- the latest dip sent global oil benchmark Brent down 25% to around $85 per barrel, and U.S. oil benchmark WTI even lower.

Brent Crude Oil Spot Price data by YCharts

Energy traders are betting that oil prices will keep falling. In a recent Bloomberg article, Citigroup's global head of energy strategy, Seth Kleinman, was quoted as saying that, "several big, smart commodity hedge funds said oil is going to zero." He went on to say, "they are being somewhat dramatic, but they were incredibly bearish."

Bearish oil bets are growing

These speculators are increasingly putting their money on bigger bets that oil prices will keep plunging. Over the past month, hedge funds and other large speculators lowered their net-long positions in WTI by 4.8% according to the U.S. Commodity Futures Trading Commission, or CFTC. Meanwhile, short positions in oil jumped almost 8% in the past month. These two factors likely played a role in accelerating oil's plunge in recent weeks as it went into bear market territory.

Speculators have long had an impact on the price of oil, and even OPEC has come out to blame speculators for oil's most recent decline. In its bi-monthly bulletin the organization said that, "the actions of speculators are again behind much of the price decline." Still, OPEC isn't planning on cutting production at the moment, as it can handle lower oil prices while speculators make a few bucks on the downside. After all, let's not forget that in the past OPEC made quite a lot of money when speculators sent oil prices spiking higher, as in July of 2008. So it's not ready to break the speculators just yet.

How low could speculators push oil prices?

There is certainly reasons to be bearish on oil prices, at least in the short term. Oil production in the U.S. is up to a 28-year high, while demand will be lower this year than it was in 2012. With so much oil coming out of one of the world's top oil consumers, it's no surprise that oil prices are finally falling.

How far oil prices will go before hitting bottom is anyone's guess. However, oil producers in the U.S. will likely cut spending to drill new wells if oil prices stay at their current levels for too long. Meanwhile, if oil prices fall to around $70 per barrel, producers will likely make even deeper cuts. Finally, oil prices in the $60 range mean that the U.S. oil boom would likely screech to a halt as producers dramatically cut spending, and jobs too. This is all assuming OPEC doesn't cut its production first.

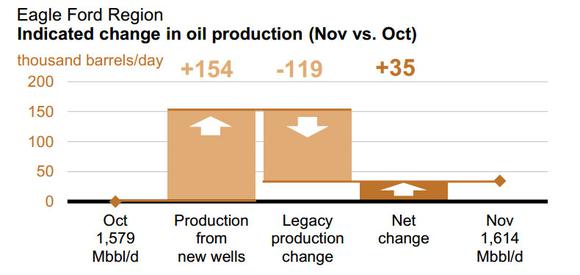

However, leaving OPEC out of the equation, it is unlikely that oil would go below $60 per barrel and stay there for too long. The spending cuts by American oil companies will have an even more immediate impact, because oil production from shale wells declines rapidly. Take a look at the following chart of oil production from the Eagle Ford shale in Texas.

Source: U.S. Energy Information Administration.

All the money producers are pouring into the Eagle Ford shale right now is expected to yield production from new wells of 154,000 barrels of oil per day. However, net production is rising by just 35,000 barrels per day, because the production from previously drilled wells is expected to decline by 119,000 barrels per day. So once producers start to cut spending, production from new wells will dry up and the change in legacy production will eat into production.

Oil will never be free

Because of this dynamic it won't take long before oil production in the U.S. begins to fall. This would work to stabilize oil prices in the short to medium term, and likely cause oil prices to start heading higher in the longer term. So don't bank on oil ever being free. Instead, get used to the fact that oil prices, while volatile, will likely always push higher.

"As significant as the discovery of oil itself!"

Recent research by the U.S. Energy Information Administration has already tabbed this "Oil Boom 2.0" with a downright staggering current value of $5.8 trillion. The Motley Fool just completed a brand-new investigative report on this significant investment topic and a single, under-the-radar company that has its hands tightly wrapped around the driving force that has allowed this boom to take off in the first place. Simply click here for access.

The article Hedge Funds Say Oil Is Going to $0 originally appeared on Fool.com.

Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments