Filed under: Investing

Gold prices have shown no mercy for gold miners this year. It's no surprise that companies like Kinross Gold , Eldorado Gold , and Yamana Gold trade near their yearly lows. Despite this, Kinross Gold recently opened its high-grade Dvoinoye mine in Russia. Will it help the company weather the gold price storm?

Slashing expenditures

The price of gold falls fast, and companies have a hard time keeping pace with it and pushing their costs lower. Kinross Gold sold its production for an average $1,331 per ounce in the third quarter. This number will clearly be lower in the fourth quarter barring some sort of miracle.

Capital expenditures are the first thing to slash in such an environment. Kinross Gold lowered its 2013 capital expenditure guidance from $1.6 billion to $1.4 billion. What's more, the company expects that its 2014 capital spend would come in the $800 million-$900 million range.

The Dvoinoye mine in Russia will contribute 235,000-300,000 ounces of gold annually for Kinross. The company will spend just $200 million-$300 million on growth next year, as $600 million is going to be spent on the sustaining capital.

Eldorado Gold makes similar moves. The miner has delayed the expansion of its Kisladag project in Turkey. Eldorado has already reduced this year's capital expenditures budget by 36% and exploration budget by 48%.

Yamana Gold has managed to decrease its all-in sustaining costs by 12% since the first quarter. Despite unfavorable price conditions, Yamana is expecting a production increase in the fourth quarter. However, as most other miners, Yamana is targeting significantly lower expansionary capital levels in 2014.

Some safety cushion left

The long-term problem that can arise for gold miners is that they cannot defer new projects forever. At some point, a company must replenish depleting reserves. However, this problem is not likely to occur in the short or even medium-term. Companies' project pipelines were fueled by increases in gold prices in previous years. All they have to do now is complete what they've already started.

To do this, producing an ounce of gold must be cheaper than selling it. Kinross is in good position with its new Dvoinoye mine, as Russia is a low-cost territory for the miner. In the first three quarters of the year, Kinross had an all-in sustaining cost of $1,045 per ounce. As Dvoinoye reaches full production, this figure is likely to decline further.

Given that the company cut its capital expenditures target for the next year and suspended the dividend, Kinross has some safety cushion against the further drop in gold prices. With $932 million of cash on hand in the end of the third quarter and $1.5 billion of undrawn credit facility, Kinross' financial position looks solid. The company's long-term debt is less than $2.1 billion, and there are no material debt maturities prior to 2016.

Bottom line

Kinross' financial position and cost profile look good, but downside risks persist. If gold prices continue to decline, it's likely that the company will not contribute any money to growth in the coming year. Also, I don't expect that the dividend will be reinitiated in 2014.

The company already trades at an almost 25% discount to book, but is likely to trade even lower in the near term. Gold price decline dominates investors' minds right now, and miners' shares will test their yearly lows as gold drifts down to $1,200 per ounce.

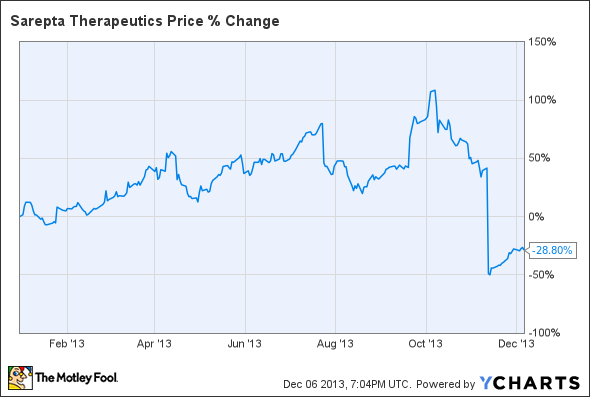

The Motley Fool's Top Stock for 2014

The market stormed out to huge gains across 2013, leaving investors on the sidelines burned. However, opportunistic investors can still find huge winners. The Motley Fool's chief investment officer has just hand-picked one such opportunity in our new report: "The Motley Fool's Top Stock for 2014." To find out which stock it is and read our in-depth report, simply click here. It's free!

The article Will Kinross Gold's New Mine Offset Lower Prices? originally appeared on Fool.com.

Vladimir Zernov has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments