Filed under: Investing

Other than the occasional short squeeze, nothing drives Netflix stock so much as exclusive content. But don't take my word for it. Witness what happened after House of Cards and Hemlock Grove pushed viewing hours to new highs. (More than 4 billion, according to the latest data.)

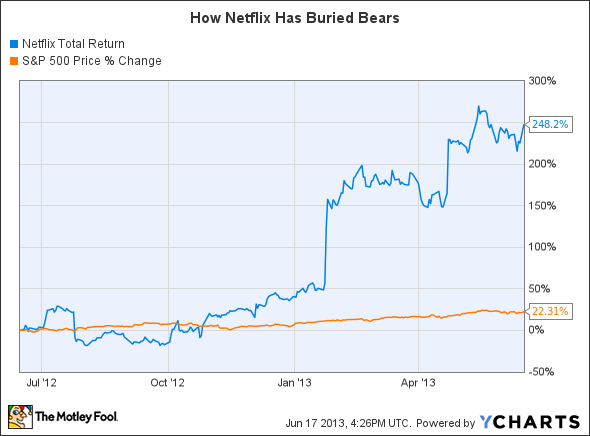

Netflix stock has more than doubled year to date and is up nearly 250% since last summer.

NFLX Total Return Price data by YCharts.;

If original content is at least partially responsible for the rally, then the natural question for investors is: What's next? We know Jenji Kohan's Orange Is the New Black is on the way. Other in-development projects include a second season of House of Cards and Sense8 from the Wachowskis and J. Michael Straczynski of Babylon 5 fame.

And after that? Surely there are other small projects in the works, plus a rotating schedule of exclusive content that includes a big deal with Walt Disney for rebroadcasting of the highly successful Marvel films. (The Iron Man franchise alone already accounts for $2.4 billion in worldwide box office receipts.)

But it'll take years to get all those movies. In the meantime, resuscitating popular but recently canceled television shows could become a catalyst for Netflix stock even as Amazon.com sharpens its focus on five originals: two adult comedies (i.e., Alpha House and Betas) and three kids' shows (i.e., Annebots, Creative Galaxy, and Tumbleaf).

To be clear, I'm not talking about doubling down on Arrested Development. I'm talking about newer shows with a niche following, such as The Killing. Here are three canceled shows whose earlier seasons are already available on Netflix:

-

Among all the things I saw at Denver Comic-Con earlier this month, nothing surprised or delighted me so much as getting to meet Eddie McClintock, who plays Agent Pete Lattimer in this soon-to-be defunct SyFy channel show about hunting down and "bagging and tagging" powerful artifacts for storage in a mysterious warehouse located in the South Dakota wilderness. (Netflix ratings: 886,436; IMDb stars: 7.3) -

Terriers

A seedy, funny, and surprising detective series starring Donal Logue as a recovering alcoholic P.I. operating without a license and whose partner and best friend is a former thief played by Michael Raymond-James. (Netflix ratings: 115,593; IMDb stars: 8.1) -

Another Joss Whedon show canceled early -- (cough) Firefly (cough) -- that starred Eliza Dushku as one of a number of programmable "dolls" for hire through their employers, a network of corporate-controlled "dollhouses." (Netflix ratings: 863,535; IMDb stars: 7.3)

Skeptics will argue that Netflix would do better developing entirely new properties. Trouble is, promoting new shows isn't cheap. Netflix spent $129 million on marketing in the first quarter alone, about even with last year's Q1. A rush of newer originals could make it harder to keep a lid on costs.

Cult hits such as Warehouse 13 don't need the same marketing support. Think about it: McClintock and co-stars Joanne Kelly, Saul Rubinek, and Allison Scagliotti have already won over the more than 800,000 who have rated the show on Netflix. That's a powerful tailwind, one that might prove better at boosting Netflix's bottom line than would investing in an untested idea.

Now it's your turn to weigh in. Would you have Netflix bring back any of these shows? Leave a comment to let us know what you think, and whether you would buy, sell, or short Netflix stock at current prices.

Go ahead, touch that dial

The television landscape is changing quickly, with new entrants such as Netflix and Amazon.com disrupting traditional networks. The Motley Fool's new free report "Who Will Own the Future of Television?" details the risks and opportunities in TV. Click here to read the full report!

The article 3 Canceled Shows That Could Do Wonders for Netflix Stock originally appeared on Fool.com.

Fool contributor Tim Beyers is a member of the Motley Fool Rule Breakers stock-picking team and the Motley Fool Supernova Odyssey I mission. He owned shares of Netflix and Walt Disney at the time of publication and was also long January 2014 Netflix $50 call options. Check out Tim's Web home and portfolio holdings, or connect with him on Google+, Tumblr, or Twitter, where he goes by @milehighfool. You can also get his insights delivered directly to your RSS reader.The Motley Fool recommends and owns shares of Amazon.com, Netflix, and Walt Disney. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments