Filed under: Investing

The retail industry has become increasingly competitive, with each player trying to capture more market share. Every retailer is planning its own way of luring customers and making its products attractive. One company's gain in customers is a loss for others.

For example, J.C. Penney , the owner of a chain of department stores, lost customers because of poor strategic decisions such as eliminating promotions for its products and removing private-label brands from its stores. This led to a sharp decline in customer traffic, which largely affected sales. This benefited its rivals such as Macy's , which reported a great third quarter that was beat analysts' expectations. The positive report then sent Macy's shares higher.

Macy's success

Macy's revenue surged 3.3% to $6.28 billion over the prior year, and earnings jumped 31% to $0.47 per share. This was all thanks to strong marketing efforts by the company. Its increased promotions led to higher customer traffic with a bigger average transaction size, resulting in a comparable-store sales growth of 3.5%.

Macy's witnessed growth in all of its segments in all regions, and especially in the women's section. Products for women were not faring well in the last few months, but strong results for women's apparel, handbags, cosmetics, and jewelery made the company optimistic about this segment's future.

Not all companies have benefited from J.C. Penney's customers, however. Another player, Kohl's , witnessed a decline in customer traffic which led to lower revenue. Kohl's comparable-store sales decreased 1.6%, which disheartened its investors. The retailer's lackluster performance was not limited to just the top line, though; its bottom line also shrank and was accompanied by a lowered outlook for the year. Nonetheless, Kohl's is trying to revive its business by adding new brands and focusing on marketing strategies to help it attract customers.

J.C. Penney is making efforts to improve its sales as well. It has restarted its promotional activities and issued discount coupons. It has also reintroduced the private-label brands which were previously removed from its stores. These strategies could help the company to stage a comeback.

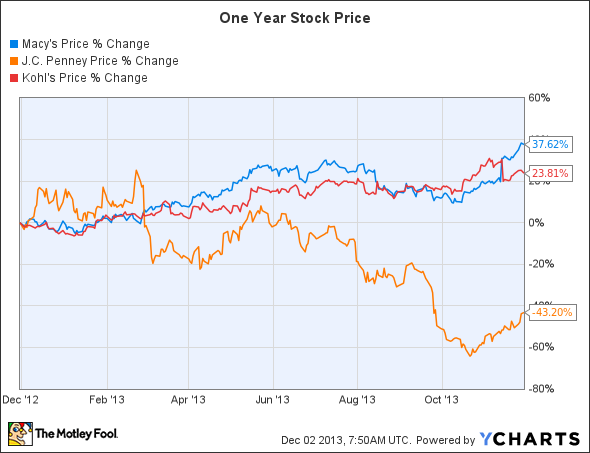

Macy's is doing well compared to peers such as Kohl's and J.C. Penney, and this is reflected in its stock price performance over the past year.

Macy's continued marketing efforts, the expansion of its online business, and new store openings enabled the company to perform well and led to a 37.6% surge in its stock price. Although Kohl's is struggling, it has managed to provide a 23.8% return to its investors. On the other hand, J.C. Penney's stock price plunged 43.2%, mainly because of the missteps taken last year.

The peak season

Macy's seem to be well positioned for a great holiday season as it enters with a large customer base.

Moreover, the decline in gas prices has left potential customers with more money. This means that customers will be willing to spend during the holiday shopping season, which is the peak season for all retailers. This has already started showing up as October sales were good for Macy's. Even rival J.C. Penney witnessed a 0.9% increase in sales over last month. In fact, its online sales jumped 37.6% over October 2012, making retailers even more hopeful about the holiday season.

All of this will be accompanied with increased promotional activity from all of the retailers. It will be interesting to see how discounting strategies help each of the players enhance their sales during the peak season.

The bottom line

Although all retailers are trying to attract customers through various means, Macy's has done the best. Its great results and bright outlook make the company even more interesting. Moreover, it has performed better than its peers. This company should be a rewarding one in the coming months.

Can Macy's rule retail?

To learn about two retailers with especially good prospects, take a look at The Motley Fool's special free report: "The Death of Wal-Mart: The Real Cash Kings Changing the Face of Retail." In it, you'll see how these two cash kings are able to consistently outperform and how they're planning to ride the waves of retail's changing tide. You can access it by clicking here.

The article A Few Reasons Why You Should Consider Macy's for Your Portfolio originally appeared on Fool.com.

Pratik Thacker has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments