Filed under: Investing

On Dec. 13, pop superstar Beyoncé surprised fans and retailers alike with the unexpected release of her fifth studio album, the self-titled, 14-track album, Beyoncé, for $15.99 as an Apple iTunes exclusive. Unlike most other iTunes albums, there is no option to purchase the tracks separately, and each track comes with an accompanying music video with three additional video clips.

It was a stunning coup by Apple -- it had secured the exclusive digital release of a high-demand album, which was not offered to brick-and-mortar retailers or other digital streaming sites such as Spotify, Rdio, and Pandora .

Album art from her previous album, 4. Source: Wikimedia.

Beyoncé's release pleased fans, and the "visual album" has already sold nearly 830,000 albums as of Dec. 16, but brick-and-mortar retailers were not amused.

In response to her decision to offer it through iTunes first, Target announced that it would not sell a hard copy of Beyoncé's new album when it is released. In an interview with Billboard, a Target spokeswoman said that "when a new album is available digitally before it is available physically, it impacts demand and sales projections".

It's doubtful that Beyoncé is losing sleep over Target's decision -- her album has already broken the first-week digital sales record for an album in the United States, and will debut at No. 1 on Billboard's Top 200 albums chart next week.

However, Beyoncé's new album highlights the ongoing battle between digital and brick-and-mortar retailers in media sales. Let's take a look at how much digital distribution channels like iTunes have affected sales of physical CDs over the past few years.

Physical vs. Digital Music Sales: 2007-2013

As 2013 comes to an end, total physically packaged music sales in the U.S. will decrease to $13 billion -- nearly half of its sales in 2007, the same year that Apple introduced the iPhone.

Digital music sales, on the other hand, have risen from $2 billion to $10 billion during the same period, thanks to robust growth in online stores like iTunes and streaming services. Packaged music revenue will only account for 55% of total music sales by the end of 2013 -- down from 61% last year.

Based on those figures, it's easy to see what will happen in 2014 and beyond -- stores like Target, Wal-Mart , and Best Buy will have an increasingly tough time selling physical CDs. To make matters worse, brick-and-mortar stores must deal with two digital threats -- online markets and streaming music.

Beyoncé's album is a clear vote of confidence for online markets, and not the streaming music that companies like Spotify, Rdio, and Pandora offer.

Selling the entire album, rather than individual tracks, reflects the opinions of several other musicians, such as Jon Bon Jovi, who disapproves of selling an album by individual tracks. Back in 2011, Bon Jovi famously accused Steve Jobs of destroying the "magical experience" of purchasing an entire album, which he considers a complete work of art.

What this means for brick-and-mortar retailers

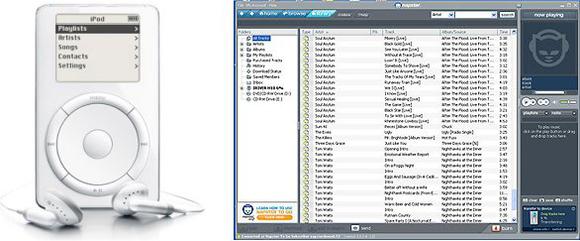

The impact of digital music on brick-and-mortar retailers started with the introduction of Apple's iPod in 2001. Prior to the iPod, MP3 players could only hold the equivalent of a single album on a memory stick. The iPod, which was fitted with a mini-hard drive, could store 1,000 songs.

The iPod arrived at a crucial time for music retailers. Sales of CDs had been plunging since 1999, following the launch of Napster, the controversial file-sharing service that became a hotbed of pirated music. Best Buy, which purchased Musicland (formerly known as Sam Goody) in 2001, was forced to unload the chain two years later after its annual revenue plunged by 20%.

Two game-changers: The iPod (2001) and Napster (1999). Source: Apple, Pcmag.com.

On its own, Musicland tried to embrace downloadable music and ringtones at download terminals in its stores. It didn't help, since it made little sense to visit a store to accomplish what could be done from a computer at home. As a result, the chain filed for bankruptcy protection in 2006 and closed most of its stores.

Today, there aren't many dedicated CD/Vinyl chains like Musicland left in the United States. This is what the current retail music market looks like, according to Billboard:

|

Company |

Apple iTunes |

Wal-Mart |

Amazon |

Target |

|

2013 Market Share |

41% |

10% |

9% |

5% |

Source: Billboard.

Although Target has made a stand against Beyoncé for being snubbed, Wal-Mart appears to have taken advantage of its rival's aggressive stance, stating that Wal-Mart was "happy to be able to carry her album and support all physical music."

What this means for other musicians

Beyoncé's new album highlights four interesting facts --

-

Releasing an album first via digital distribution is a viable way to test the market without launching an expensive full-scale physical release.

-

Digital albums can provide plenty of attractive bonuses, such as extra music videos.

-

The opinion of brick-and-mortar stores like Target doesn't matter very much.

-

In the near future, musicians could decide to cut physical retailers out of the loop altogether.

Beyoncé's move could represent the start of a major shift in the music industry -- one which could encourage more artists to digitally release their albums first. Over time, physical CDs could fade away just as records and cassette tapes did over the past few decades.

What do you think, dear readers? Will Beyoncé's new album change how musicians release their albums in the future? Let me know in the comments section below!

To learn about two retailers with especially good prospects, take a look at The Motley Fool's special free report: "The Death of Wal-Mart: The Real Cash Kings Changing the Face of Retail." In it, you'll see how these two cash kings are able to consistently outperform and how they're planning to ride the waves of retail's changing tide. You can access it by clicking here.

The article Beyoncé's New Album Gets Snubbed by Target Due to Earlier iTunes Release originally appeared on Fool.com.

Fool contributor Leo Sun has no position in any stocks mentioned. The Motley Fool recommends Apple and Pandora Media. The Motley Fool owns shares of Apple. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments