Filed under: Investing

Corning has been at the forefront of technology for decades, ironically using one of the oldest substances in civilization -- glass -- to make products for use in everything from vast fiber-optic networks to your handheld mobile device. Yet, as much attention as Corning gets from its prominent placement within smartphones from Apple , Samsung, and other popular device makers, Corning's turnaround stems from a much broader-based recovery that has wider implications for the entire industry. Let's take a closer look at what happened with Corning this year, and whether its stock will keep rising in 2014.

Corning's Willow Glass. Source: Corning.

What made Corning shine brighter this year?

As instrumental as Corning has been for many industries in its long history, the company's Gorilla Glass product has been a huge blockbuster. In a conference call early this year, Corning revealed that more than a billion devices containing Gorilla Glass had been sold, with 500 different product lines containing the material. With so many people buying smartphones, tablets, and other devices using Gorilla Glass, it's easy to assume that the fortunes of Corning are inexorably linked to those of Apple, Samsung, and other manufacturers of those devices.

But the beginning of Corning's upswing in late April and early May came after Corning CEO Wendell Weeks gave an enthusiastic view of the company's prospects. Simply because of the sheer amount of glass involved, LCD televisions have been an incredibly important market segment for Corning, and that industry has seen weak sales cause poor demand for glass. Corning, however, gave positive guidance that price declines in the LCD market would finally slow down, helping to boost potential demand. That bore out in Corning's second-quarter earnings, with Display Technologies posting a 21% jump in revenue.

In addition, Corning also stands to benefit from greater activity in telecommunications and life sciences, both of which are areas of growth potential for the company. Corning's $730 million acquisition of most of the Discovery Labware unit of Becton Dickinson late last year gave it greater exposure to the pharmaceutical and health-care diagnostics sectors, with products including plastic lab tubes, flasks, and analysis dishes, as well as products for handling liquids. That move helped the Life Sciences segment earnings double from previous-year levels in the second quarter.

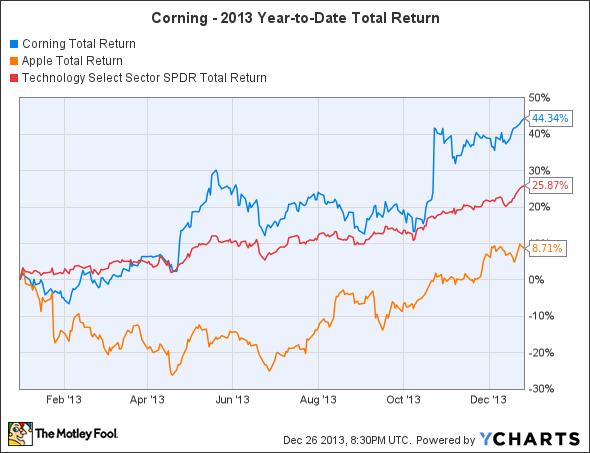

Corning Total Return Price data by YCharts

Some have noted that Corning's relationship with Apple isn't necessarily permanent. Fears at midyear that Apple might replace Gorilla Glass with a sapphire-based alternative proved unfounded -- at least for purposes of the fall release of the iPhone 5s and 5c. Yet, just last month, Apple entered into a major deal with sapphire producer GT Advanced Technologies , once again raising the question of Corning's staying power. For now, sapphire use might be limited to especially sensitive areas, but expanded use could threaten Gorilla Glass in the long run.

That made Corning's biggest news of the year all the more important, as shares surged when the company made a deal with Samsung whereby Corning took over full control of the Samsung Corning Precision Materials joint venture in exchange for Samsung taking a 7% stake in Corning. The move deepens Corning's relationship with the mobile-device giant, and puts it in a better bargaining position with Apple and other customers, all the while hopefully allowing Corning to benefit when Samsung's display sales finally start to accelerate.

Stats on Corning

|

Revenue, Past 12 Months |

$8.01 billion |

|

1-Year Revenue Growth |

3.3% |

|

Net Income, Past 12 Months |

$1.79 billion |

|

1-Year Net Income Growth |

(9.4%) |

Source: S&P Capital IQ.

What's next for Corning?

One question that remains largely unanswered is the prospect for Corning's Willow Glass, a flexible glass product that many believe could revolutionize the mobile world by making smart watches possible, as well as having applications in solar energy and other industries. Corning's competitive edge has traditionally kept it ahead of the pack, and so making the most of the Willow Glass opportunity could help shares power higher.

For the most part, though, the key to Corning's growth will come from its Samsung deal. If the integration of the Precision Materials business goes well, then Corning could see much further gains than it enjoyed in 2013.

Get growth on your side

High-growth stocks are one way that Fool co-founder David Gardner has proved skeptics wrong, time, and time, and time again, with stock returns like 926%, 2,239%, and 4,371%. In fact, just recently one of his favorite stocks became a 100-bagger. And he's ready to do it again. You can uncover his scientific approach to crushing the market and his carefully chosen six picks for ultimate growth instantly, because he's making this premium report free for you today. Click here now for access.

Click here to add Corning to My Watchlist, which can find all of our Foolish analysis on it and all your other stocks.

The article How Corning Soared 44% in 2013 originally appeared on Fool.com.

Fool contributor Dan Caplinger owns shares of Apple. You can follow him on Twitter @DanCaplinger. The Motley Fool recommends Apple, Becton Dickinson, and Corning. The Motley Fool owns shares of Apple and Corning. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments