Filed under: Investing

Although we don't believe in timing the market or panicking over market movements, we do like to keep an eye on big changes -- just in case they're material to our investing thesis.

A much weaker than expected jobs report has given investors enough pause to sell off stocks slightly today, sending the Dow Jones Industrial Average down 0.11% as of 3:30 p.m. EST. The Department of Labor said the U.S. economy only added 74,000 jobs last month, the fewest in three years, although the unemployment rate fell 0.3% to 6.7% because of a lower labor participation rate.

There are a number of theories as to why December's numbers were so bad. Cold weather may have kept some companies from hiring and workers from venturing out. It could also have something to do with how the Department of Labor adjusts for the seasonality of hiring, which may have pushed November's glowing report higher and December's abysmal report lower. When you average them out they show a continued slow recovery in employment, which is probably closer to the real story than the highs and lows of the last two months.

Chevron takes it on the chin

One company dragging on the Dow today is oil giant Chevron , which is down nearly % after issuing interim fourth-quarter production results last night. Chevron's fourth quarter 2013 liquids production fell from 1,795 million barrels of oil per day (MBD) in the year-ago quarter to 1,722 MBD; natural gas production was also down slightly, although refining volume was up.

The challenge is that lower oil prices will hurt the profit made from the upstream business and increased refining margins will help ExxonMobil more than Chevron because it has more refining capacity.

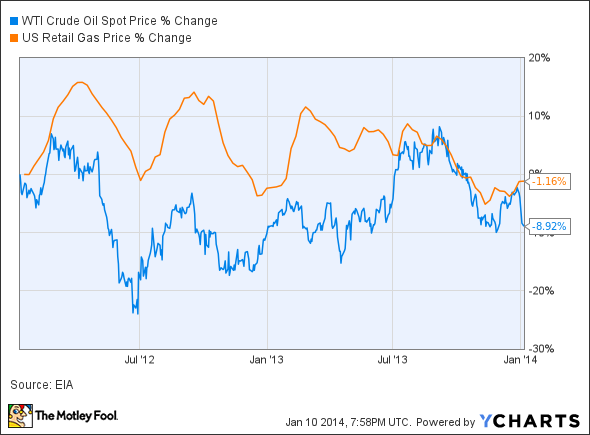

Right now, there's an ebb and flow between whether production, refining, or marketing of petroleum products will see margins increase or decrease quarter to quarter. The challenge is that higher production costs haven't been passed to customers in the form of higher gas prices, so as oil goes up and down refiners and explorers benefit differently.

Image may be NSFW.

Clik here to view.

WTI Crude Oil Spot Price data by YCharts.

Recently, oil has been down so refiners will see the benefit, which is why Chevron is down and ExxonMobil isn't hit so hard. The trend will likely switch in the future as oil prices go up and down.

What investors should be more worried about long term is that gas prices are slowly falling and it's becoming more expensive to extract oil. That'll squeeze profits for everyone on the value chain and is bad for both Chevron and ExxonMobil.

How to really make money in energy

Imagine a company that rents a very specific and valuable piece of machinery for $41,000... per hour (that's almost as much as the average American makes in a year!). And Warren Buffett is so confident in this company's can't-live-without-it business model, he just loaded up on 8.8 million shares. An exclusive, brand-new Motley Fool report reveals the company we're calling OPEC's Worst Nightmare. Just click HERE to uncover the name of this industry-leading stock... and join Buffett in his quest for a veritable LANDSLIDE of profits!

The article Chevron Underperforms a Sagging Dow originally appeared on Fool.com.

Fool contributor Travis Hoium has no position in any stocks mentioned. The Motley Fool recommends Chevron. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments