Filed under: Investing

Why were investors so surprised that President Obama wanted to launch a "war on coal"? They were warned during his first presidential campaign that he wanted to bankrupt anyone that operated a coal-fired power plant so it's a given this administration has a deep-rooted animus against the industry.

Even so, coal stocks plummeted following Obama's speech with Peabody Energy and Alpha Natural Resources dropping 8% and Arch Coal down more than 6%. Using an end-run around Congress to implement overreaching regulations through executive order are a worrisome possibility even if they'll have minimal impact on carbon emissions. Why? Because China doesn't care a whit about it and they'll continue burning coal regardless of presidential platitudes.

The U.S. coal industry can survive this latest assault because its production capabilities are already gearing toward supplying the Orient's insatiable demand for it. And while thermal coal largely been a small component of our exports, we're likely to see that expand. Further, nearly 70% of all metallurgical coal produced in the U.S. is exported overseas and it carries higher margins than does thermal coal.

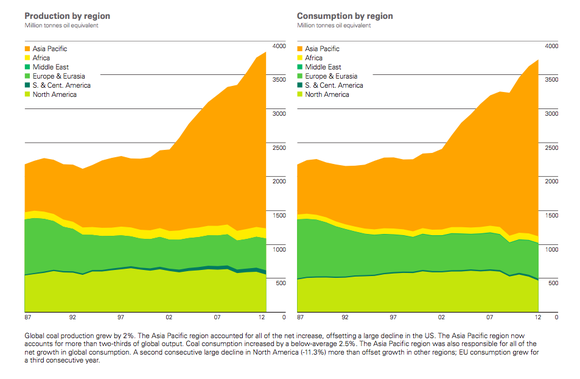

According to BP's latest review of world energy, global oil consumption grew 0.9% in 2012 and natural gas rose 2.2%. Yet it was King Coal that led the way with a 2.5% rise in global consumption.

Admittedly, that's almost half the rate it was growing over its 10-year average, or 4.4%, but it shows that many countries, particularly China, still view this cheap, abundant resource as a key component of their economic development and growth.

Indeed, growing at a 6.1% clip, China was the biggest consumer of coal anywhere in the world, and for the first time ever accounted for more than half of the resources consumption. It is coal that allows developing economies to achieve growth while the U.S. hamstrings its efforts by placing impediments in the path to coal.

Consumption in the U.S. declined almost 12% in 2012, more than offsetting the gains realized in Europe and Japan and almost single-handedly causing the 4.4% drop in consumption in OECD countries.

Source: BP Statistical Review of World Energy, June 2013.

Now there are still risks inherent in the international trade. Goldman Sachs says the seaborne trade for coal may wane over the next few years because China's own production of coal has jumped at the same time its economy is slowing. Exports have slumped as a result and an inventory glut has grown in Asia.

Although problematic, not everyone's convinced the China trade is doomed. Peabody, the largest private coal company, is looking for the seaborne trade for thermal coal to grow this year after total coal imports to China grew 30% in the first quarter to 80 million tons. India is also a major coal-consuming nation and imports rose 25% in the quarter allowing the subcontinent to surpass Japan as the second-largest thermal coal importer.

While Peabody and Arch have largely abandoned the higher-cost Appalachia coal region, they've turned their sights to the Powder River Basin in Montana and Wyoming, where more coal can be exported. Arch's first-quarter sales in the Basin were down slightly sequentially as prices fell, but its cash margins per ton jumped 30%.

The Powder River Basin produces 500 million tons of coal annually, most of it for domestic consumption, but only because there's not enough of an export infrastructure in place to support it. While there had been six export terminals planned for the West Coast, after Kinder Morgan cancelled its plans for a terminal in northern Oregon, it marked the third one that had been cancelled.

These are hurdles the coal industry can surmount, even in the fog of battle. The International Energy Association says the world will burn around 1.2 billion more tons of coal per year by 2017 than it does today, equal to the coal Russia and the U.S. combined are currently consuming. It will almost surpass oil as the world's top energy source.That's a trend I'd still be willing to count on, even if the miners themselves are fighting with one hand tied behind their backs.

There are many different ways to play the energy sector, and The Motley Fool's analysts have uncovered an under-the-radar company that's dominating its industry. This company is a leading provider of equipment and components used in drilling and production operations, and poised to profit in a big way from it. To get the name and detailed analysis of this company that will prosper for years to come, check out the special free report: "The Only Energy Stock You'll Ever Need." Don't miss out on this limited-time offer and your opportunity to discover this under-the-radar company before the market does. Click here to access your report -- it's totally free.

The article Don't Count Coal Stocks Out Yet originally appeared on Fool.com.

Fool contributor Rich Duprey has no position in any stocks mentioned. The Motley Fool recommends Goldman Sachs. It recommends and owns shares of Kinder Morgan. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments