Filed under: Mortgages, Refinancing, Home Buying, Credit History, Credit Score

Both consumer credit scores and the real estate market have improved in recent years from the doldrums of the housing collapse and ensuing recession. Not only are there fewer distressed homeowners these days, but we're also on pace for a 9 percent increase in annual home sales during 2014 as well as an until-further-notice continuation of Federal Reserve policies designed to keep interest rates low and stimulate economic growth.

"Current mortgage rates remain very attractive by historical standards, though they have climbed just over half a percent from the levels in 2012," Michael L. Bognanno, chairman of the economics department at Temple University, told WalletHub in a recent interview. "Because current inflation and expected future inflation are at low levels and unemployment, while gradually falling, remains high, I expect the Federal Reserve to continue the course of depressing interest to promote growth, employment and the recovery of the housing market."

In other words, even though home prices are on track to rise 11 to 12 percent in 2014, the current landscape is very appealing for consumers who have solid credit and the ability to place a sizable down payment on a home. Why are those factors so important? Because the higher your credit standing and down payment are, the better your odds of mortgage approval will be and the less you will pay when all is said and done.

Good credit will also help you save on mortgage insurance if you don't have the recommended 20 percent for a down payment. According to a recent WalletHub Study, low-down-payment applicants can save roughly $3,500 to $13,000 in just five years by opting for private mortgage insurance instead of a Federal Housing Administration loan, with the upper bounds for people with strong credit.

The question, therefore, is how to make sure your credit standing is ready for prime time. While much depends on your purchase timeline, there are a few steps that all potential homebuyers should take to prepare their finances for the big day.

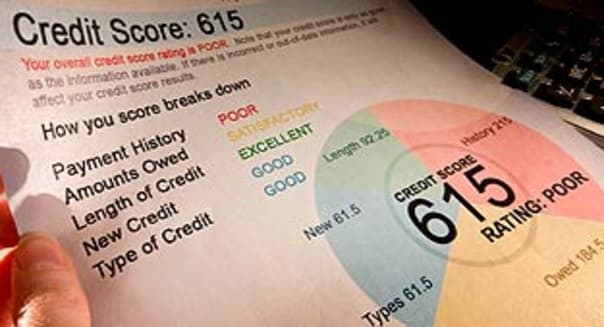

- Determine where you stand. There are a number of free ways to estimate your credit standing, and doing so will enable you to evaluate your starting point as well as develop a plan to improve your applicant profile if necessary.

- Check your credit reports for errors and fraud. The National Consumer Law Center reports that research by consumer groups shows that up to 25 percent of consumer credit reports contain errors significant enough to cause a denial of credit. Finding unauthorized financial accounts listed on your credit report is also one of the easiest ways to spot fraud. And since we are all entitled to a free copy of each of our major credit reports once every 12 months, there's no reason not to make sure everything is in order before getting too deep into the home buying process.

- Pay bills on time and minimize credit utilization. Payment history and amounts owed together account for roughly 65 percent of your credit score. Given that potential lenders are likely to be most concerned about recent performance, it's important that you pay all credit card and loan bills by the due date and use only a fraction of the credit made available to you in the months leading up to a home purchase.

- Maximize savings. The bigger your down payment, the more you will save on a home purchase. That's obvious, since you'll be borrowing less, paying less in interest over the life of your mortgage and assuming full ownership of your home sooner. Making a budget that eliminates unnecessary expenses and maximizes savings should therefore be a no-brainer for anyone seriously contemplating buying a home, especially considering the added cost of moving and furnishing a new home.

- Be strategic about opening a new credit card. Credit cards are the most efficient credit building tools available to consumers, as they report account information to the major credit bureaus monthly without necessitating that you get into debt (unlike a loan). As long as this information reflects timely payments and low credit utilization, it will lead to credit score improvement over time. But opening a new credit card account can diminish your credit score for a few months. That means it's wise to get a new card only when you have the better part of a year before your planned home purchase.

Odysseas Papadimitriou, a widely respected personal finance expert, is CEO of the credit card comparison website CardHub and the new social network WalletHub, where consumers can compare home loans and read reviews on mortgage brokers.