Filed under: Investing

Photo credit: ConocoPhillips

The Eagle Ford Shale just keeps getting bigger. ConocoPhillips was the latest company to point out that its oil position in the play is much bigger than previously thought. In fact, the company now estimates that its position in Texas' Eagle Ford Shale is actually 40% larger than earlier estimates. Because of the company's vast technical knowledge of the play it now estimates that its acreage position now holds 2.5 billion barrels of oil.

Why the Eagle Ford Shale continues to grow

As Eagle Ford Shale focused drillers have developed the play, we've continued to see upward revisions to previous resource estimates. EOG Resources , for example, noted that its resource potential in the Eagle Ford Shale is now 45% than its previous estimate. EOG Resources now sees its oil recovery in the play being 3.2 billion barrels of oil equivalent, which is 250% higher than its original estimate. A combination of better data on wells, improved completion techniques and downspacing of wells are all providing a noticeable boost.

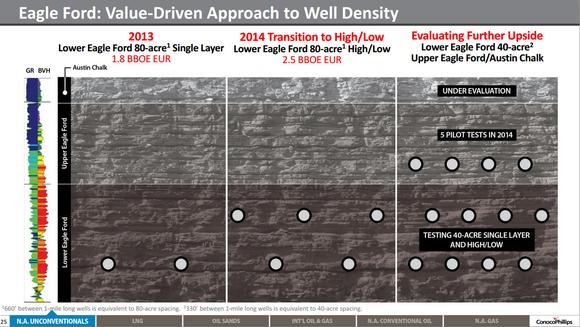

We might not have seen the last boost in resource potential from either company. As the following slide shows, ConocoPhillips is still evaluating further upside opportunities within its Eagle Ford Shale acreage.

Source: ConocoPhillips Investor Presentation (Link opens a PDF)

The company is working on tighter spacing of its wells in addition to testing the Upper Eagle Ford Shale. Beyond that there could be potential for the Austin Chalk on its acreage position. The fact that EOG Resources has already demonstrated success with tighter 40 acre well spacing bodes well for ConocoPhillips suggesting it likely will add even more recoverable oil in the future.

In addition to these tests energy companies continue to improve well designs in order to get more oil out. EOG Resources recently demonstrated that it can produce enormous quantities of oil from its wells as its getting better at finding the right mix to get more oil out of each section. The company recently reported stunning well results to the Texas Railroad Commission as five of its newest wells produced 13,000 barrels of crude oil per day. With shale wells producing over a thousand barrels per day considered exceptional, these wells which averaged between 2,314 to 3,071 barrels of oil per day were truly remarkable. Finding the right keys to unlocking the oil trapped in the rocks not only improves returns but it improves the ultimate recovery of oil from the play. ConocoPhillips is finding that changes it made to well designs has resulted in it doubling its cumulative production.

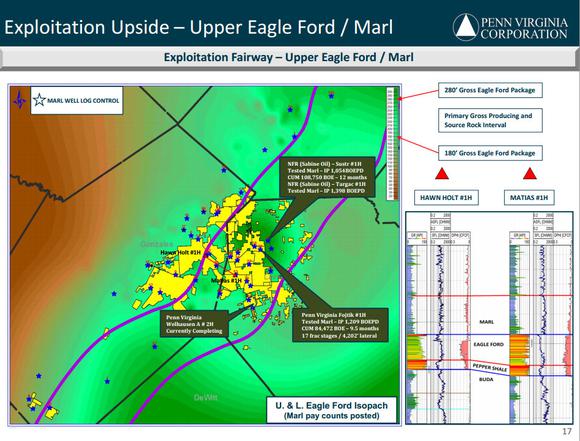

Then there is the Upper Eagle Ford Shale and the Austin Chalk that hold upside promise to extend growth for Eagle Ford leaseholders. While ConocoPhillips has a handful of wells planned this year to explore the Upper Eagle Ford Penn Virginia Corporation is already one step ahead of it. As a slide from a recent investor conference showcases, Penn Virginia has already seen solid results from that formation.

Sources: Penn Virginia Corporation Investor Presentation (Link opens a PDF)

While its still early, the results experienced by the industry so far is compelling enough to entice producers to explore that section. As producers delineate the Upper Eagle Ford and Austin Chalk there is the possibility that the play will continue to keep getting bigger.

What this means for investors

ConocoPhillips sees its Eagle Ford Shale position producing 250,000 barrels of oil equivalent per day, or BOE/d by 2017. That's growth of more than 100,000 BOE/d from the 141,000 BOE/d the company was producing out of the Eagle Ford just last quarter. Given the upside it's seeing within the play, there is likely more production growth to come beyond 2017 as the company continues to optimize the development of this play. That should yield even better long-term returns for its investors.

OPEC is absolutely terrified of this game-changer

The Eagle Ford Shale has America on the verge of energy independence. However, that really doesn't bother OPEC. What has it terrified is a game-changing new technology that could make you a lot of money. In an exclusive, brand-new Motley Fool report we reveal the company we're calling OPEC's Worst Nightmare. Just click HERE to uncover the name of this industry-leading stock.

The article This Texas Oil Play Keeps Getting Bigger originally appeared on Fool.com.

Matt DiLallo owns shares of ConocoPhillips. The Motley Fool owns shares of EOG Resources. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments