Filed under: Investing

Disney's Magic Kingdom got a bit more expensive this year. Source: Disney.

The news wasn't announced with a Disney press release. But it did turn a few heads when the company boosted theme park ticket prices back in February. The fee for admission into the Magic Kingdom crept up to $99 from $96, and other parks saw a similar bump.

That move was odd for at least two reasons. First, the House of Mouse often raises prices closer to the summer months, right before the crush of tourists hits. Second, the talk at the time was all about just how weak the outlook was for consumer spending in the year ahead. It seemed like a tricky time to be asking for more cash from your customers.

Now we know why Disney decided to increase those theme park prices anyway: Because it could.

Magical earnings

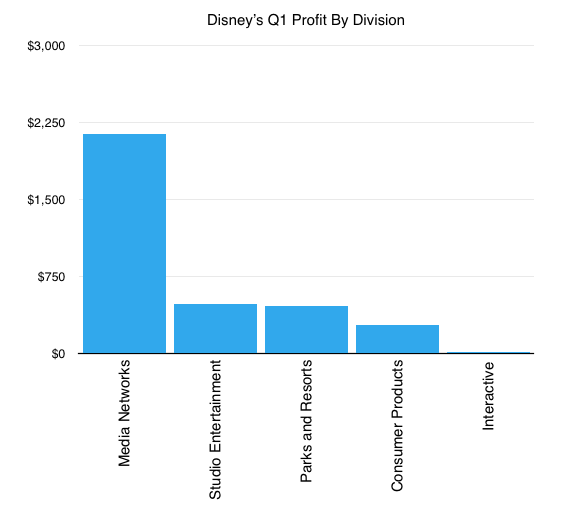

The company announced blockbuster quarterly earnings results this week, with most of the press attention going to the Frozen-fueled spike in studio profits. That's understandable. The theater business unit leapt up three spots to become Disney's second most profitable division behind only its media business, which is the home of ESPN.

Profit in millions. Source: Disney financial filings.

But the parks and resorts arm is still worth almost a third of Disney's total revenue, and its numbers were just as impressive. Profit leapt higher by 19% on an 8% boost in sales, the company said. However, those figures actually understate the division's earning power, courtesy of a calendar shift that cut out one week of the Easter holiday from this year's results. Account for that shift, and parks and resorts income would have been up a massive 31% last quarter.

Here's how Disney explained the improvement in its earnings announcement:

Higher operating income was due to growth at our domestic parks and resorts driven by increased guest spending at Walt Disney World Resort, higher attendance at Disneyland Resort and increased occupied room nights at both resorts. Higher guest spending was due to higher average ticket prices and food, beverage and merchandise spending.

In other words, Disney exercised its pricing power modestly in the quarter and customers responded -- by purchasing more of what the House of Mouse was selling.

What it all means

Investors have to be happy about that result, as it means Disney's prices are nowhere near the level where they'd start to hurt customer demand at the parks. And that business is much more reliable than movies, anyway, where one flop can offset a whole year's profits.

The bottom line for shareholders is that while Disney's movie business can sometimes book great quarters like the one that just ended, theme parks are a much more consistent contributor, with a lot of growth left to kick in over the years ahead.

Say goodbye to your credit card

Even while prices keep going up, the way we pay for things is about to change. The plastic in your wallet is set to go the way of the typewriter, the VCR, and the 8-track tape player. When it does, a handful of investors could stand to get very rich. You can join them -- but you must act now. An eye-opening new presentation reveals the full story on why your credit card is about to be worthless -- and highlights one little-known company sitting at the epicenter of an earth-shaking movement that could hand early investors the kind of profits we haven't seen since the dot-com days. Click here to watch this stunning video.

The article This Is Why Disney Raised Ticket Prices originally appeared on Fool.com.

Demitrios Kalogeropoulos owns shares of Walt Disney. The Motley Fool recommends Walt Disney. The Motley Fool owns shares of Walt Disney. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments