Filed under: Investing

Dividend stocks outperform non-dividend-paying stocks over the long run. It happens in good markets and bad, and the benefit of dividends can be quite striking -- dividend payments have made up about 40% of the market's average annual return from 1936 to the present day.

But few of us can invest in every single dividend-paying stock on the market, and even if we could, we're likely to find better gains by being selective. Today, two of America's largest defense contractors will square off in a head-to-head battle to determine which offers a better dividend for your portfolio.

Tale of the tape

Established in 1922, Raytheon Company is one of the United States' largest defense contractors -- it ranked fifth in government contracts awarded for 2010 -- with a focus on defense systems and defense electronics. Raytheon is also a Global Fortune 500 corporation with more than 63,000 employees around the world, and it is the largest producer of guided missiles in the world. Headquartered in Waltham, Mass., Raytheon also provides commercial electronics products and services along with food-safety processing technologies, but it still generates the majority of its revenue from U.S. defense contracts.

Established in 1939, Northrop Grumman Corporation is one of the world's largest defense contractors -- ranking third in contracts awarded for 2010 -- offering innovative electronics systems, information and unmanned systems, cyber-security, and logistics services to government and commercial customers. Headquartered in Falls Church, Virginia, Northrop Grumman is a Global Fortune 500 corporation, employing more than 68,000 people around the world. The company recently completed its acquisition of Qantas Defence Services, while in recent years it has also divested its shipbuilding subsidiary to focus on high-tech defense and security.

|

Statistic |

Raytheon |

Northrop Grumman |

|---|---|---|

|

Market cap |

$30.9 billion |

$26.6 billion |

|

P/E ratio |

15.6 |

13.9 |

|

Trailing-12-month profit margin |

9.0% |

8.4% |

|

TTM free cash flow margin* |

9.9% |

6.9% |

|

Five-year total return |

150.6% |

231.5% |

Source: Morningstar and YCharts.

*Free cash flow margin is free cash flow divided by revenue for the trailing 12 months.

Round 1: endurance (dividend-paying streak)

Raytheon has paid dividends without interruption since 1964 -- a full half-century of dividends. However, Raytheon falls short against Northrop's streak, as the latter has paid quarterly dividends for more than 63 years in a row since its first distributions in 1951.

Winner: Northrop Grumman, 1-0.

Round 2: stability (dividend-raising streak)

According to Dividata, Raytheon has increased its payouts every year since 2005, giving it a nine-year dividend-raising streak. On the other hand, Northrop has increased its quarterly distributions for a full decade since it began the practice in 2004, which gives it a narrow edge -- and the stability crown -- against Raytheon.

Winner: Northrop Grumman, 2-0.

Round 3: power (dividend yield)

Some dividends are enticing, but others are merely tokens that barely affect an investor's decision. Have our two companies sustained strong yields over time? Let's take a look:

RTN Dividend Yield (TTM) data by YCharts.

Winner: Raytheon, 1-2.

Round four: strength (recent dividend growth)

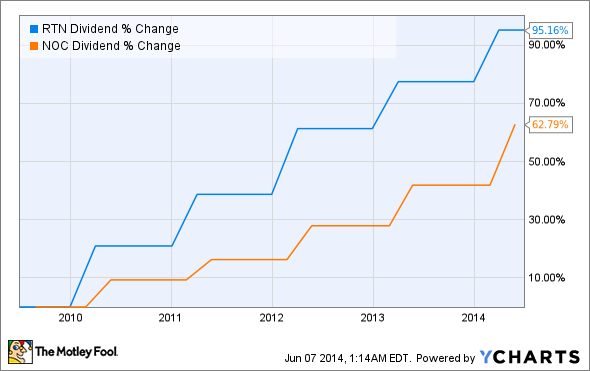

A stock's yield can stay high without much effort if its share price doesn't budge, so let's take a look at the growth in payouts over the past five years.

RTN Dividend data by YCharts.

Winner: Raytheon, 2-2.

Round five: flexibility (free cash flow payout ratio)

A company that pays out too much of its free cash flow in dividends could be at risk of a cutback, particularly if business weakens. We want to see sustainable payouts, so lower is better:

RTN Cash Dividend Payout Ratio (TTM) data by YCharts.

Winner: Northrop Grumman, 3-2.

Northrup may trail by the narrowest margin today, but over the past five years, it's clearly kept its payouts at a more sustainable level overall, which earns it the final victory -- and the overall title -- in our dividend contest today.

Bonus round: opportunities and threats

Northrop Grumman may have won the best-of-five on the basis of its history, but investors should never base their decisions on past performance alone. Tomorrow might bring a far different business environment, so it's important to also examine each company's potential, whether it happens to be nearly boundless or constrained too tightly for growth.

Raytheon opportunities:

- Raytheon won more than $3.5 billion in contracts this year to manufacture interceptor missiles.

- Raytheon's MK-60 Patrol Coastal Griffin Missile System will soon be deployed on Navy ships.

Northrop Grumman opportunities:

- Japan plans to spend $240 billion on Northrop's surveillance drones and other military hardware from Boeing and Textron.

- Global spending on unmanned aerial vehicles (UAVs) is projected to reach $89 billion by 2025.

Raytheon threats:

- Lockheed Martin has nearly $1.8 billion in contracts for its competing Aegis Ballistic Missile Defense system.

Northrop Grumman threats:

- Boeing's Phantom Eye UAV platform could steal share from Northrop's RQ-4 Global Hawk.

One dividend to rule them all

In this writer's humble opinion, it seems Northrop Grumman has a better shot at long-term outperformance, thanks to the anticipated surge in spending on surveillance drones around the world, and because of its role in supplying a huge amount of hardware to Japan over the coming years. Raytheon could also wind up benefiting from increased demand for missiles as a UAV countermeasure, but its manufacturing focus seems less aligned with the interests of tomorrow's militaries. You might disagree, and if so, you're encouraged to share your viewpoint in the comments below. No dividend is completely perfect, but some are bound to produce better results than others. Keep your eyes open -- you never know where you might find the next great dividend stock!

Top dividend stocks for the next decade

The smartest investors know that dividend stocks simply crush their non-dividend paying counterparts over the long term. That's beyond dispute. They also know that a well-constructed dividend portfolio creates wealth steadily, while still allowing you to sleep like a baby. Knowing how valuable such a portfolio might be, our top analysts put together a report on a group of high-yielding stocks that should be in any income investor's portfolio. To see our free report on these stocks, just click here now.

The article Raytheon Company vs. Northrop Grumman Corporation: Which Stock's Dividend Dominates? originally appeared on Fool.com.

Alex Planes has no position in any stocks mentioned. The Motley Fool owns shares of Lockheed Martin, Northrop Grumman, Raytheon Company, and Textron. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments