Filed under: Investing

General Electric hasn't been a simple business since Thomas Edison founded the conglomerate's first ancestor. A hundred years ago, Edison Electric had already adopted its new name, and had branched out from making electric light bulbs to locomotives, ceramic stove tops, power generators, X-ray machines, and plastics.

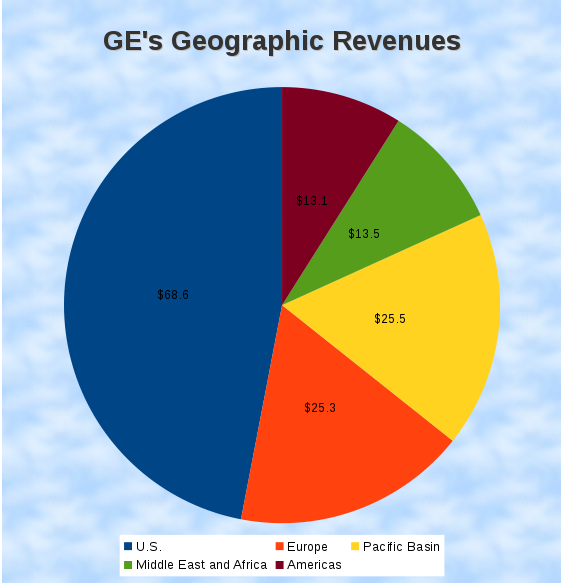

Source: GE.

Nothing much has changed in the last century. GE is still around and it still runs one of the largest, most complex industrial conglomerates on the planet. You might expect GE to compete with other heavy manufacturing groups, such as Honeywell International or United Technologies, and you'd be right -- but that's far from GE's whole story. The company also faces off against more surprising rivals, like National Oilwell Varco and Citigroup .

No joke. This old company really gets around. So, how does today's General Electric make money? Let's take a deeper look at GE's sprawling operations.

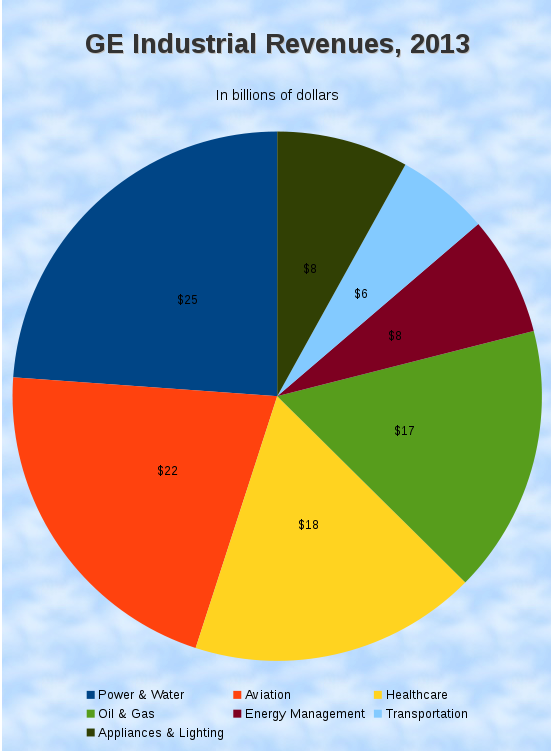

Source data: GE 10K filing.

Starting with a world map, General Electric is very much a global business.

The U.S. market is key, of course, representing 47% of GE's sales in 2013. But that still leaves 53% coming from abroad.

And the geographic mix is changing. Sales have remained stable in the Americas over the last two years, while European revenues fell by 10%. Making up for the Old World drop, GE expanded sales by 10% in Asia and 13% in the Middle East and Africa segment.

In other words, GE's meat and potatoes are still served at home, but the company is very connected to the world's fastest-growing economies.

That's what GE looks like today.

30% of the conglomerates sales come from GE Capital, the financial arm. This is why some compare GE to global banks like Citigroup. The company is selling off its financial services for consumers to refocus on business-class banking operations. This includes fleet management services, commercial loans, and commercial leases.

General Electric and GE Capital used to sport a AAA Standard & Poor's credit rating, which is the highest possible credit quality. After the 2008-2009 financial crash, these ratings have dropped to AA+ -- still the second highest rating in S&P's system.

GE Capital exited 2013 with $380 billion in Ending Net Investment, which is GE Capital's closest thing to the Basel III assets reported by other large banks. That's down from $419 billion in 2012 and $445 billion in 2011, and GE has its sights set on reaching an ENI as low as $300 billion.

This company wants to become less of a megabank, and more of an industrial powerhouse. In 2011, GE held about 35% as much invested capital as Citigroup -- not bad for a supposed industrial complex! Today, the GE-to-Citigroup capital ratio is down to 32%.

Digging deeper into the industrial side of the house, you'll find four very large sub-divisions and three smaller operations. But even here, the mix is changing quickly.

GE has grown its energy management sales by 18% in the last two years, while oil and gas services jumped 25% higher. In a series of energy-focused acquisitions, GE is indeed becoming comparable to National Oilwell and other giants of petroleum drilling and transport equipment.

Treating GE's energy management and oil segments as a unified business, its $25 billion in 2013 revenues would have surpassed National Oilwell's total sales. GE's energy equipment and services would still rank behind the absolute top layer of this industry, but we're still looking at one of the top names in oil drilling supplies. Again, not bad for a diversified conglomerate.

And GE is still working on its ideal business mix, here. If the proposed $13.5 billion buyout of French rival Alstom's power plant and electrical grid operations passes regulatory muster, the deal would instantly boost GE's power and water sales by 80%. This would go a long way toward boosting industrial sales past 75% of total revenue, which is another of GE's stated long-term goals.

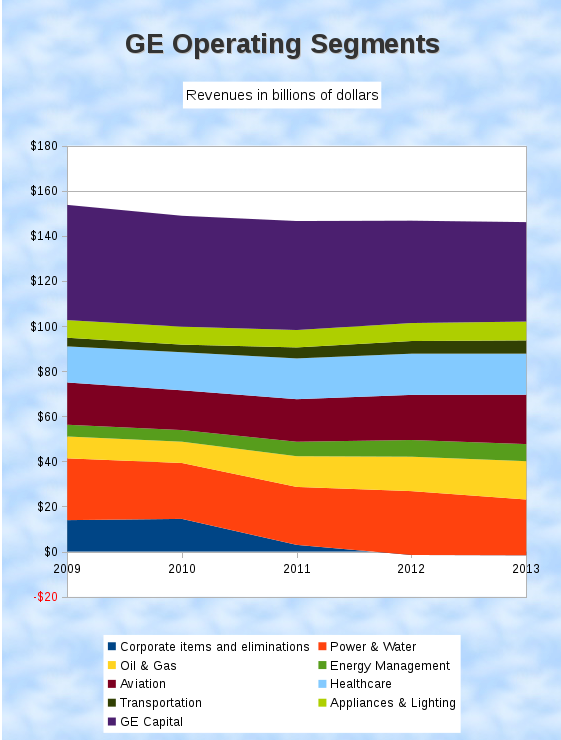

Let's finish up with GE's segment sales over time. This is how the company has rebalanced its operating portfolio in the last five years. The blue wedge that disappeared in 2011 mainly consists of the NBC Universal media division, which was sold to Comcast for $30 billion.

That's a high-level view of GE's complex operations. Long story short:

-

GE rakes in about half of its sales from the Americas and the rest from distant shores.

-

Financial services are huge but destined to shrink.

-

You should expect the industrial mix to change often.

Warren Buffett just bought nearly 9 million shares of this company

Imagine a company that rents a very specific and valuable piece of oil-drilling machinery for $41,000 per hour (that's almost as much as the average American makes in a year!). And Warren Buffett is so confident in this company's can't-live-without-it business model, he just loaded up on 8.8 million shares. An exclusive, brand-new Motley Fool report details this company that already has over 50% market share. Just click HERE to discover more about this industry-leading stock... and join Buffett in his quest for a veritable landslide of profits!

The article How Does General Electric Make Money? originally appeared on Fool.com.

Anders Bylund has no position in any stocks mentioned. The Motley Fool recommends National Oilwell Varco. The Motley Fool owns shares of Citigroup, General Electric, and National Oilwell Varco. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments