Filed under: Investing

Shares of First Solar have jumped over 18% year to date. What is driving the stock higher? And can the company's stock keep rising? Here are four factors driving First Solar's value higher.

1. Higher sales

During the first quarter, the company's sales grew by 26% year over year. This year, its net sales are expected to be in the range of $3.7 billion to $4 billion -- a 12% to 21% rise compared to 2013. This expected gain will mostly be driven by First Solar's plans to expand its production to between 1.9 GW and 2 GW in 2014 -- nearly 14.7% higher than in 2013.

Moreover, in order to maintain this growth, it plans to increase its capital expenditures by around 15% to an expected average of $325 in 2014. This higher capex will keep driving the company's sales higher this year and in the coming years.

2. Rise in average conversion efficiency

First Solar has been improving its average conversion efficiency in recent years -- the chart below shows the modest gain in its average conversion efficiency.

Source: First Solar .

The rising rate could improve the company's standing in relation to its competitors such as SunPower . SunPower is considered the industry leader, with an average conversion efficiency of 20%. Moreover, the company recently recorded 25% efficiency in one of its reproduction solar cells.

3. Improved margins in the first quarter

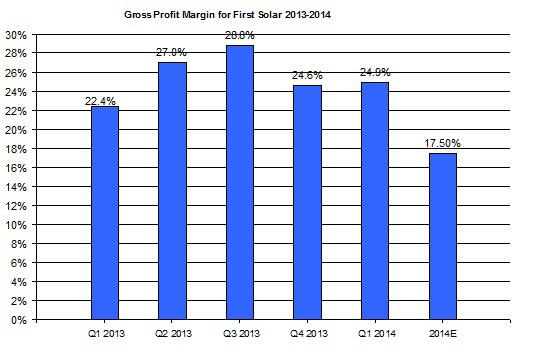

The company estimates its gross profitability to be between 17% and 18% this year. In comparison, back in 2013 its gross margin was 26%. This lower profit margin is projected to slash the company's earnings per share: First Solar also projects its EPS to be between $2.20 and $2.60; back in 2013, its EPS was much higher at $3.70. Despite this outlook, the company has done well in the first quarter as indicated in the chart below.

Source: First Solar .

As you can see, the company's gross profit margin grew in the past quarter to 24.9%, which is 2.5 percentage points higher than the same quarter last year. Moreover, its EPS reached $1.10 -- a higher than anticipated figure. Therefore, even though First Solar expects to see lower earnings per share and narrower margins, it kicked off the year on a positive note. If the company continues to show better than expected results in the second quarter, this could further boost its stock. Finally, in order to offset the potential drop in margins, the company is improving its operating profit by slashing costs.

4. Reduced SG&A expenses

In the past several quarters, the company has reduced its selling, general, and administrative costs -- in the past quarter alone, its SG&A costs dropped by 21%. These steps taken to slash costs are likely to improve its operating margin. Based on last year's figures, for every 10% fall in SG&A costs, First Solar's operating profitability is expected to rise by nearly 1 percentage point.

Foolish bottom line

First Solar is making the right decisions in order to improve its operations and maintain high sales growth. If the company continues to outperform its earnings per share guidance, then the march higher will likely continue.

Take advantage of America's energy boom -- and this little-known tax "loophole"

You already know record oil and natural gas production is changing the lives of millions of Americans. But what you probably haven't heard is that the IRS is encouraging investors to support our growing energy renaissance, offering you a tax loophole to invest in some of America's greatest energy companies. Take advantage of this profitable opportunity by grabbing your brand-new special report, "The IRS Is Daring You to Make This Investment Now!," and you'll learn about the simple strategy to take advantage of a little-known IRS rule. Don't miss out on advice that could help you cut taxes for decades to come. Click here to learn more.

The article 4 Factors Driving First Solar's Stock Higher originally appeared on Fool.com.

Lior Cohen has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments