Filed under: Investing

Source: Wikipedia

If you're an investor in either Kinder Morgan Inc (NYSE: KMI) or Kinder Morgan Energy Partners (NYSE: KMP), one of the largest and most well known pipeline master limited partnerships, or MLPs, you've likely already heard the argument of the law of large numbers. In other words, as Kinder Morgan has gotten so large, going forward, it will be increasingly difficult to grow. In fact, after the last Kinder Morgan article I wrote, one commenter said exactly that. He claimed that many other pipeline MLPs would outperform Kinder Morgan over the next ten years.

To Kinder Morgan's defense, there are smaller pipeline MLPs that have trouble growing at all. Some are diluting ownership considerably. Some have even had to cut distributions. While bigger in size, Kinder Morgan is a safer choice in the pipeline space. Still, I think the point was a good one: Kinder Morgan will have some trouble growing into the future. That's why today I will look at a better candidate for long-term growth, Williams Partners LP (NYSE: WPZ).

Williams might be the best pipeline pick for the next five to ten years. Consider the following: Williams is concentrated on dry gas and natural gas liquids, of which demand is growing from both the thriving petrochemical industry and power. Contrast that with oil, whose demand in North America is flat at best. Also, Williams is a much smaller partnership than is Kinder Morgan; Williams' market cap is just under $25 billion. It will be much easier for Williams to 'move the needle' with capital projects.

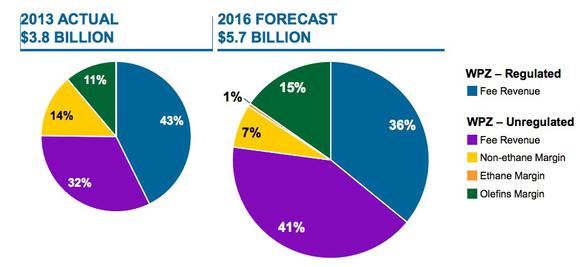

Courtesy of Williams Partners Investor Relations

And 'move the needle' this partnership shall. The above chart shows Williams' tremendous gross margin growth, which is made possible by a very impressive $25 billion capital program over the next five years. Almost half of Williams' capital will go into Atlantic-Gulf pipeline systems, which will move gas from the new supply area, the Marcellus Shale, to the burgeoning demand system, the Gulf Coast petrochemical complex. A significant amount will also be funneled into NGL and petrochemical pipelines.

The above chart shows gross margin increasing by 50% over three years. Distributable cash flow, or DCF, will follow a similar trajectory. In 2013 DCF was $1.96 billion, but by 2016 management estimates DCF to be $2.95 billion. Most of that excess cash flow should go to shareholders in the form of increased distributions. When this impressive growth is added onto an already juicy yield of 6.75%, the opportunity becomes apparent.

Bottom line

The most significant risk with Williams is its thin distribution coverage ratio of just 0.95 times. However, with such impressive growth, a sub-par distribution coverage ratio is much less relevant. Williams offers solid exposure to the natural gas infrastructure supercycle, where added supply brings lower costs and encourages increased use of natural gas. While such an environment may be challenging to producers, it is ideal for opportunistic midstream partnerships. For those looking for great growth prospects in a pipeline partnership, few, if any, match Williams' stellar growth rate. This could be an excellent long-term story.

Top dividend stocks for the next decade

The smartest investors know that dividend stocks simply crush their non-dividend paying counterparts over the long term. That's beyond dispute. They also know that a well-constructed dividend portfolio creates wealth steadily, while still allowing you to sleep like a baby. Knowing how valuable such a portfolio might be, our top analysts put together a report on a group of high-yielding stocks that should be in any income investor's portfolio. To see our free report on these stocks, just click here now.

The article Escape the Law of Large Numbers With This High-Yielding MLP originally appeared on Fool.com.

Casey Hoerth owns shares of Kinder Morgan Energy Partners LP. The Motley Fool recommends Kinder Morgan. The Motley Fool owns shares of Kinder Morgan. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments