Filed under: Investing

Yamana Gold (NYSE: AUY) and Agnico Eagle (NYSE: AEM) have completed the acquisition of the Osisko Mining Corporation . The two companies jointly acquired 100% of the company, following a failed hostile bid by rival Goldcorp (NYSE: GG).

Meaningful increase in production for Yamana

After the acquisition, Yamana's production profile is expected to increase significantly. In the next five years, Yamana's production profile will increase from 1.5 million-1.7 million ounces of gold to 1.8 million-2.0 million ounces of gold, representing an average annual increase of approx. 19% over the next five years.

Agnico, on the other hand, will see a major decline in production starting in 2017 (a number of mines, including Lapa, Goldex, and Meadowbank are going out of production) . The acquisition of Osisko will help Agnico steady its production profile over the next five years. The acquisition will also allow Agnico to develop other growth projects in the pipeline, including Kirkland Lake and/or Meliadine, in a more methodical manner rather than having to rush to address the production gap starting in 2017.

Agnico's cash costs expected to decline

Yamana is a low-cost gold producer, and while the company, post the Osisko acquisition, will see a significant increase in its production, its production costs are also expected to increase. Osisko's Canadian Malartic mine has an average cost of ~$577 per ounce, which is higher than the portfolio average of Yamana's existing assets. Therefore, the overall portfolio average cost of Yamana's assets is expected to increase post the acquisition.

Agnico, on the other hand, will witness a decline in its portfolio costs in the next five years, as Osisko's cash costs are lower than the average portfolio cash costs of Agnico.

Improved political profile

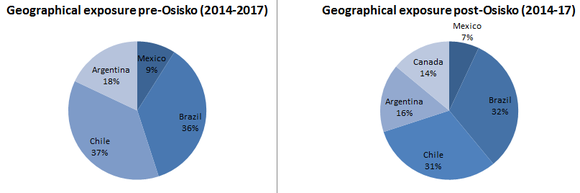

The acquisition of Osisko will improve political risk profile of both Yamana and Agnico. Yamana, which pre-Osisko acquisition had no operations in Canada, is likely to benefit more than Agnico. Prior to the acquisition, majority of Yamana's production came from the South American countries, including Chile, Brazil, and Argentina.

The acquisition of Osisko will increase Yamana's North American exposure, and specifically exposure in Canada which is historically a mining-friendly region. As of now, all of its North American production (9% of total) comes from Mexico. After the Osisko acquisition, Yamana's North American production will increase to 21% of the total production (2014-2017), of which 14% will come from Canada.

Source: Barclays

Normally, investors should be cautious of a company entering a region where it has not operated before. However, in this case, Yamana's partnership with Agnico should help mitigate that risk given Agnico's experience in the Abitibi region of Quebec.

Agnico already has a relatively low political risk profile. The majority of the company's production comes out of Finland, Mexico, and Canada. The addition of Osisko assets will only marginally improve the risk profile of Agnico, but the political risk will go down nonetheless. More than the political risk reduction, Agnico will benefit from the expected cost sharing and procurement upside. The Canadian Malartic mine is located in the Abitibi region in Quebec, where Agnico already has three other operating mines.

Balance sheet impact

After the Osisko acquisition, net debt/EBITDA for both Yamana and Agnico will increase; however, both these companies should see improvement in their balance sheets next year with the inclusion of the low-cost, high-quality Malartic mine.

Foolish takeaway

The acquisition of Osisko is positive for both Yamana and Agnico. While, Yamana, post-acquisition, will see a meaningful increase in its production in the next five years, Osisko's acquisition will also help Agnico steady its production profile in the next five years and target its other growth projects in a more methodical manner rather than rushing to address the production gap starting in 2017. The acquisition will also improve the political profile of both the companies, particularly of Yamana, which prior to the acquisition had no operating mines Canada.

Do you know this energy tax "loophole"?

You already know record oil and natural gas production is changing the lives of millions of Americans. But what you probably haven't heard is that the IRS is encouraging investors to support our growing energy renaissance, offering you a tax loophole to invest in some of America's greatest energy companies. Take advantage of this profitable opportunity by grabbing your brand-new special report, "The IRS Is Daring You to Make This Investment Now!," and you'll learn about the simple strategy to take advantage of a little-known IRS rule. Don't miss out on advice that could help you cut taxes for decades to come. Click here to learn more.

The article Yamana Gold Just Gave You 1 More Reason to Buy originally appeared on Fool.com.

Jan-e- Alam has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments