Filed under: Investing

Source: Wikimedia Commons.

Heading into earnings on June 25, investors of Bed Bath & Beyond are probably trying to figure out what to do with the stock. Currently, the company's shares are trading around 52-week lows, which could indicate some upside, but given the business's performance lately, is it possible that companies like Target or Macy's make for more attractive plays?

Mr. Market has relatively high expectations for Bed Bath & Beyond!

For the quarter, analysts expect Bed Bath & Beyond to report revenue of $2.69 billion. If this forecast turns out to be accurate, it will represent a 3% gain in revenue from the $2.61 billion management reported for the first quarter of its 2013 fiscal year.

On an earnings basis, Mr. Market is slightly less optimistic. For the quarter, Bed Bath & Beyond is expected to report earnings per share of $0.95, which should equate to a net profit of around $195 million. On a per-share basis, this will represent a 2% increase over the $0.93 management reported last year.

How does the company stack up against the competition?

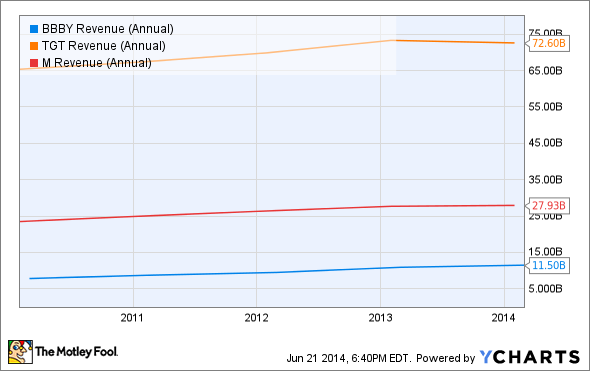

The past few years have been pretty good for Bed Bath & Beyond. Between 2009 and 2013, the retailer saw its revenue jump 47% from $7.8 billion to $11.5 billion. According to the company's most recent annual report, the biggest contributor to its sales growth during this period appears to be its store count, which rose 36% from 1,100 locations to 1,496. This was, however, complimented by the 25% increase in aggregate comparable-store-sales management reported during the period.

Source: Bed Bath & Beyond revenue data by YCharts.

During a similar five-year timeframe, Target couldn't keep pace with Bed Bath & Beyond. Between 2009 and 2013, Target's revenue rose just 11% from $65.4 billion to $72.6 billion. Looking at the company's financial statements, this mediocre growth seems to stem from a comparable-store-sales increase of just 5%, at a time when the retailer's store count rose 10% from 1,740 locations to 1,917.

Source: Bed Bath & Beyond.

Although not as impressive as Bed Bath & Beyond's metrics, Macy's has done alright for itself. Over the past five years, Macy's saw its revenue climb a respectable 19% from $23.5 billion to $27.9 billion. The main driver behind this jump in sales has been its comparable store sales, which was partially offset by a 0.7% reduction in store count from 847 locations to 841.

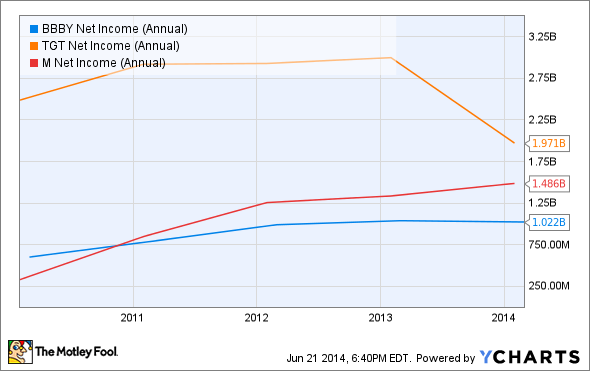

Looking at profits, Macy's has continued to do well. In fact, the company's growth over this period put both of its rivals to shame. Between 2009 and 2013, Macy's saw its net income soar 306% from $329 million to $1.3 billion. This jump in profits was due, in part, to the company's rising sales. But an even bigger component to its profitability was its selling, general and administrative expenses, which fell from 34.3% of sales to 30.2%.

Source: Bed Bath & Beyond net income data by YCharts.

The runner-up in profitability for this time horizon was Bed Bath & Beyond. During this five-year period, the retailer's net income leapt 70% from $600 million to $1 billion. Like Macy's some of this can be attributed to higher sales, but it would be reckless to ignore that the retailer's selling, general and administrative expenses dropped from 28.5% of sales to 25.7%.

Of the three retailers profiled here, the only poor performer over this period was Target, which saw its bottom line contract by 21% from $2.5 billion to nearly $2 billion. Even though revenue increased, it was plagued by higher costs. A 41% rise in interest expense during the period, its cost of goods rose from 69.7% of sales to 70.5%, and its selling, general and administrative expenses increased from 20% of sales to 21.2%. The business also booked a $17 million charge (net of insurance proceeds) stemming from a data breach that occurred last year and affected as many as 110 million customers.

Foolish takeaway

Right now, Mr. Market seems to be somewhat pessimistic about Bed Bath & Beyond's prospects. While it is possible that the company could begin sliding, management has grown its top and bottom lines by a significant amount. This suggests that investors might not want to discard this retailer before looking into it further. Based on past performance, only Macy's (because of its net income growth) might make for a more appealing prospect for a Foolish investor.

Top dividend stocks for the next decade

While Bed Bath & Beyond holds some potential for the Foolish investor, there is one thing the business does not have; dividends. In order to add value to your portfolio, one thing that you can do is to invest in businesses that post strong, stable yields that can generate income for you for years... maybe even decades... to come!

The smartest investors know that dividend stocks simply crush their non-dividend paying counterparts over the long term. That's beyond dispute. They also know that a well-constructed dividend portfolio creates wealth steadily, while still allowing you to sleep like a baby. Knowing how valuable such a portfolio might be, our top analysts put together a report on a group of high-yielding stocks that should be in any income investor's portfolio. To see our free report on these stocks, just click here now.

The article Is Bed Bath & Beyond Inc. About to Soar? originally appeared on Fool.com.

Daniel Jones has no position in any stocks mentioned. The Motley Fool recommends Bed Bath & Beyond. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments