Filed under: Investing

Clik here to view.

Source: Risky Business: The Economic Risks of Climate Change in the U.S.

A major threat is staring the U.S. economy in the face and the situation is so dire that an all-star lineup of political and business leaders have teamed up to release a blockbuster report that outlines the severe costs that businesses and investors face if no action is taken.

What calamitous threat to the U.S. economy would bring together the likes of former New York City Mayor Michael Bloomberg, former Secretary of the Treasury Henry Paulson, former Secretary of the Treasury Robert Rubin, and other A-listers? The issue is climate change, which Rubin calls "the defining issue of our era." The group they have formed in hope of tapping the business community's resources in the fight against climate change is called the Risky Business project.

In an attempt to "quantify the risks of climate change to American businesses" with a goal of spurring positive action within the business world, the Risk Committee released on Tuesday the report "Risky Business: The Economic Risks of Climate Change in the United States." The report frames climate change as an economic issue and, as Bloomberg explains, "details the costs of inaction in ways that are easy to understand in dollars and cents."

Formed in 2013, the Risky Business project, according to an open letter on its website, is "a non-partisan, independent effort that is attempting, for the first time, to analyze the economic risks of climate change for American businesses." The project also features on its "Risk Committee" former hedge fund manager Thomas Steyer, former Cargill CEO Gregory Page, former Secretary of Treasury and Secretary of State George P. Schultz, former Health and Human Services Secretary Donna Shalala, and former Republican Senator of Maine Olympia Snowe, among others.

Climate change by the numbers

Clik here to view.

Source: Risky Business: The Economic Risks of Climate Change in the U.S.

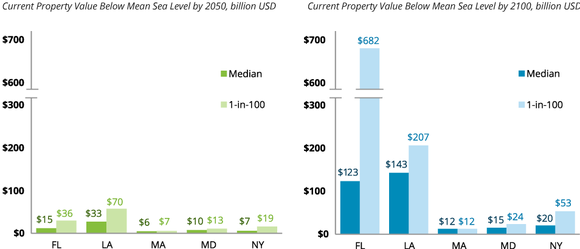

There are a number of startling statistics presented within the report's findings, all of which, if accurate, will have a significant impact on the U.S. economy. To start, an increase in temperature will reduce crop yields in the Midwest 19% by mid-century and by as much as 63% by 2100. By 2050, even more droughts and wildfires can be expected to hit the Southwest due to temperatures staying above 95 degrees for an additional month each year. Rising sea levels will cause between $66 billion and $106 billion worth of damage to existing coastal property. And extreme hot and cold weather could reduce the productivity of outdoor labor, like construction, up to 3%, especially in areas like the Southeast and the Southwest.

Taken together, along with the report's other projections, no sector of the economy seems safe from climate change. And by applying what the report calls a "classic risk assessment approach to climate change," it's evident that action needs to be taken on many fronts because "business as usual" means every region of the country and every sector of the economy will become more exposed to the risks of climate change with each passing year.

Clik here to view.

Source: Risky Business: The Economic Risks of Climate Change in the U.S.

Risky Business recommendations

The Risky Business project report highlights three general areas of action that can help reduce the impact of climate change on the U.S. economy.

The first is Business Adaptation, whereby U.S. businesses should think about the ways in which they can adapt their everyday practices to be more sustainable and resilient to climate change. The way in which farmers have always adapted and innovated within the climate in order to thrive was pointed to as a model for all businesses to emulate.

The second area of action is Investor Adaptation, which calls on corporations to begin factoring in the risk assessment of climate change into their capital expenditures and their balance sheets. Currently, over 40% of companies on the S&P 500 do not disclose their material risks to climate change, despite the Security and Exchange Commission providing guidelines on how to do so with their Interpretive Guidance on climate disclosure being issued back in 2010.

Likewise, investors need to start incorporating the risk assessment of climate change into their individual investments, whether it's with stocks in Fortune 500 companies or with bonds issued to finance projects in coastal areas.

The final area of action involves Public Sector Response and calls on governments at the local, state, and federal level to implement long-range plans that will help secure the future of U.S. business through updating infrastructure and directing public money to projects that will make the economy more resilient.

Whether the Risky Business project's strategy of appealing to the business community in the language of finance will lead to a widespread shift in views on climate change is an open question. Will corporations risk their short-term earnings for long-term investments? Will investors tolerate the impact on stock prices?

Recent history -- and an understanding of the mindset that still dominates Wall Street and board rooms across the country -- leads me to think that the business community won't change their ways on their own, at least not until it benefits their bottom line. However, the sheer star power behind the Risky Business project guarantees that this call to action will at the very least make it impossible for the business community to write climate change off as a non-issue as it has for so long.

Top dividend stocks for the next decade

The smartest investors know that dividend stocks simply crush their non-dividend paying counterparts over the long term. That's beyond dispute. They also know that a well-constructed dividend portfolio creates wealth steadily, while still allowing you to sleep like a baby. Knowing how valuable such a portfolio might be, our top analysts put together a report on a group of high-yielding stocks that should be in any income investor's portfolio. To see our free report on these stocks, just click here now.

The article Business Leaders Stress Economic Risks of Climate Change originally appeared on Fool.com.

Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments