Filed under: Investing

Target.com

A lot has been made of the Target data breach, and for good reason. It led to a lack of customer trust, a still unknown number of total future expenses related to the breach, and it cost the CEO his job.

The data breach was bad news, but it could only be a temporary hit, which could present an investment opportunity. The difference here is that the data breach isn't the only problem for Target. Canadian operations haven't been performing as well as anticipated, and Target is well behind its peers in e-commerce. Does this mean you should cross Target off your watchlist? If so, is another retailer likely to present a better long-term option?

Canadian performance

Target has 1,916 retail locations, with 1,789 of those units in the United States and 127 of those units in Canada. In the first quarter, U.S. sales increased 0.2% year over year to $16.7 billion, whereas Canadian sales came in at $393 million versus just $86 million in the year-ago quarter. As you can see, U.S. operations are still much more important.

The above slight sales increase in the U.S. might lead you to believe Target is performing well domestically, but comps (sales at stores open at least one year) declined 0.3% year over year. Additionally, gross margin slipped to 29.5% from 30.7% because of promotional markdowns. Earnings before interest expenses and income taxes also plummeted 13.5%.

Unfortunately, despite the surface numbers, Canadian operations didn't fare much better. Sales at Canadian stores were only $86 million in the year-ago quarter because there were only 24 stores at the time. This left a lot of room for improvement. Currently, there are 124 Target stores in Canada. Sales increased thanks to new store openings. It's the margins you really need to watch.

Gross margin came in at paltry 18.7% for the first quarter because of excess inventory. This number might improve going forward, but it's not a good sign. The Canadian consumer hasn't taken well to Target's pricing and merchandise mix, and in addition to competing against local retail brands, Target must fight against Wal-Mart Stores , which has had a presence in Canada for two decades. This isn't the only area where Target is lagging Wal-Mart.

E-commerce positioning

According to comScore, overall e-commerce sales increased 12% in the first quarter on a year-over-year basis to $56.1 billion. This represented 18 consecutive quarters of year-over-year growth and 14 consecutive quarters of double-digit growth. The strongest areas were apparel, accessories, consumer packaged goods, sport and fitness, digital content and subscriptions, and home and garden. Look at that list and notice that Target merchandise would fit well, for the most part. However, Target was late to the party.

Target's online sales aren't reported, but they're estimated to make up approximately 2% of total sales. For Wal-Mart, it's just shy of 4% of total sales, and Wal-Mart just delivered a 27% e-commerce sales increase in the first quarter.

The key to success is omni-channel, which allows customers to shop when, where, and how they want. For example, a good omni-channel retailer will make shopping more convenient for its customers by filling online orders quickly for faster delivery, allowing in-store pickup, and making online and mobile ordering simple.

Target does have a plan for improved omni-channel performance going forward. It has set up a council that will meet once a month to strategize. This council includes:

- Ajay Agarwal (Managing Director at Bain Capital Ventures)

- Amy Chang (CEO of Accompany, previously ran Google Analytics)

- Roger Liew (Technology Chief at Orbitz Worlwide)

- Sam Yagan (CEO of Match Group, Founder of OKCupid)

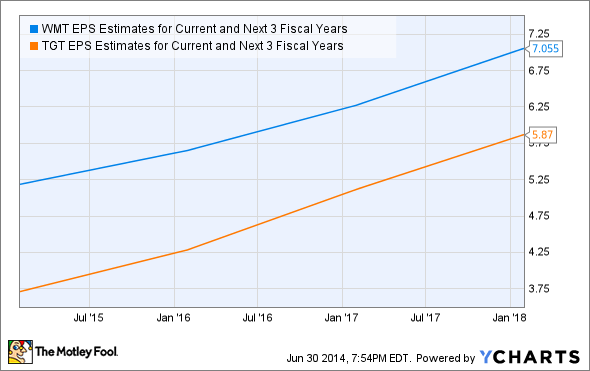

If previous and current positions are any indicator, then this is a Jedi-like omni-channel strategy group. This panel combined with other e-commerce initiatives (i.e. more sorting options on mobile devices, Save for Later in mobile basket, streamlined mobile checkout, dynamic customized landing pages), Target should see e-commerce improvements going forward. However, savvy investing is about going with companies that deliver continuous and sustainable profits. Wal-Mart falls into this category much better than Target does at the moment. It's performing better domestically, in Canada, and in e-commerce. It also has a new growth avenue with its small-box stores, and its earnings-per-share is expected to remain ahead of Target's for the current and next three fiscal years:

WMT EPS Estimates for Current and Next 3 Fiscal Years data by YCharts

Therefore, if you're going to invest in one of these retailers over the other, then you might want to consider Wal-Mart first.

A technology that should change the world, and you can invest in it!

The best investors consistently reap gigantic profits by recognizing true potential earlier and more accurately than anyone else. Let me cut right to the chase. There is a product in development that will revolutionize not just how we buy goods, but potentially how we interact with the companies we love, like Target and Wal-Mart, on a daily basis. Analysts are already licking their chops at the sales potential. In order to outsmart Wall Street and realize multi-bagger returns, you will need The Motley Fool's new free report on the dream-team responsible for this game-changing blockbuster. CLICK HERE NOW.

The article Target's Problems Beyond the Data Breach originally appeared on Fool.com.

Dan Moskowitz has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments