Filed under: Investing

Exchange-traded funds offer a convenient way to invest in sectors or niches that interest you. If you'd like to add some real estate investment trusts, or REITs, to your portfolio but don't have the time or expertise to hand-pick a few, the iShares US Real Estate ETF could save you a lot of trouble. Instead of trying to figure out which stocks will perform best, you can use this exchange-traded fund to invest in lots of REITs simultaneously.

Why this ETF, and why REITs?

Adding some exposure to your portfolio via real estate can really boost its diversification, but actually owning real estate can be costly and risky. So consider REITs instead. They trade like stocks and offer instant diversification and the ability to invest in a range of properties, such as residential, commercial, industrial, retail, and medical. Better still, REITs must pay out at least 90% of their income in the form of dividends, so they're good income-generators for a portfolio.

ETFs often sport lower expense ratios than their mutual fund cousins. This ETF is no exception, with an annual fee of 0.46%. It edged ahead of the world market over the past decade and topped it handily over the past five years. The ETF yields about 3.6%, too -- more than many of its peers.

A closer look at some components

On your own you might not have selected American Realty Capital Properties or Annaly Capital Management as REITs for your portfolio, but this ETF includes them among its 100 holdings.

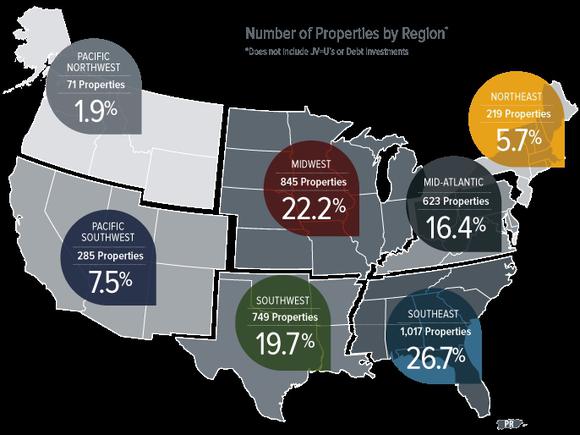

The geographical diversification of American Realty Capital Properties. Source: arcpreit.com.

American Realty Capital Properties

American Realty Capital Properties, which went public less than three years ago, is the largest publicly traded "net lease" REIT (as measured by enterprise value) and one of the largest U.S. REITs. It focuses on single-tenant retail and office properties and, as a net-lease REIT, expects tenants to pay some (or all) of the expenses associated with the property, such as maintenance, taxes, utilities, and insurance. Its hefty 7.9% dividend yield attracts considerable interest, but there are some compelling reasons to think twice before investing in it.

For one thing, the company is growing briskly via acquisition, which is costing it a lot in debt and has also led the company to issue a lot of stock, diluting the value of existing shares. Then there are its earnings: It doesn't have any yet, and its free cash flow is negative, meaning it's burning cash. One of the company's most recent deals was spending $1.5 billion on 500 Red Lobster properties. There are favorable terms to the deal, but Red Lobster is not exactly flourishing.

It's not all bad, though. The company does sport 3,809 properties across the U.S. now, with a very high portfolio occupancy rate, above 99%. These properties are generating lease payments (many from big, well-known tenants), which makes for relatively reliable income. American Realty Capital Properties carries considerable debt, but it's mostly fixed-rate and low-interest.

There's growth potential here, but risk, too. Before investing, consider waiting for net gains instead of net losses and a slowdown or reversal of debt and share-count growth.

Annaly Capital Management

Annaly Capital Management, the largest mortgage REIT, or "mREIT," offers an even more gargantuan dividend yield -- 10.3%. Here, too, investors should proceed with caution, as steep dividends are sometimes too good to be true. Annaly's dividend has been cut before and may well be cut again. Like other mREITs, Annaly is vulnerable to interest rate increases, and with rates having been low for a long time, increases will come sooner or later. Still, Federal Reserve Chairwoman Janet Yellen expects that rates will not rise quickly anytime soon.

Meanwhile, those interested in Annaly can also take heart in knowing that insiders have been buying shares lately. Insider buying is rarely anything but a sign of confidence. The company has also taken steps to reduce its risk somewhat by decreasing its leverage and by acquiring commercial property specialist Crexus -- the commercial market is seen as more stable than the residential one. Annaly stock is trading at a lower valuation than many of its peers, too.

All that might make the stock seem like a great income-generator for your portfolio. You might still want to steer clear, though, because of Annaly's management. The company has been criticized for its lavish executive compensation, and in response, it changed its structure so that it no longer discloses compensation levels. That's not very shareholder-friendly, and it's enough to keep me away.

Interested in more big dividends?

The smartest investors know that dividend stocks simply crush their non-dividend-paying counterparts over the long term. That's beyond dispute. They also know that a well-constructed dividend portfolio creates wealth steadily, while still allowing you to sleep like a baby. Knowing how valuable such a portfolio might be, our top analysts put together a report on a group of high-yielding stocks that should be in any income investor's portfolio. To see our free report on these stocks, just click here now.

The article Two Massive Dividends: Annaly Capital and American Realty Capital originally appeared on Fool.com.

Longtime Fool specialist Selena Maranjian , whom you can follow on Twitter , has no position in any stocks mentioned. Neither does The Motley Fool. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments