Filed under: Investing

Source: King Digital Entertainment

King Digital Entertainment shares took a beating post-IPO, but have since recovered to above the listing. Investors have grown less wary about King's business model as the dependence on Candy Crush Saga lessens and a spinoff hits the market. Can King continue its upswing, or will shares plummet to the $3 range of Zynga ?

Supplement Candy Crush Saga with its spinoff

Candy Crush Saga accounted for 67% of overall bookings in the first-quarter report, which was a marked improvement from the 78% pre-IPO dependence. King will soon widely release the spinoff Candy Crush Soda Saga in hopes of diversifying its game portfolio.

Two similar games can have success at the same time. Zynga's first-quarter report showed that three games accounted for 64% of overall online game revenue, and two of the games were Farmville titles. Candy Crush Soda Saga, like Farmville 2, doesn't offer a significantly different gaming experience from the original. Soda has better graphics, but more importantly, better monetization incentives to lure players into paying for extra levels or game pieces.

Grow the game portfolio

King has existed for more than a decade and has churned out 180 titles. The bookings dominance of Candy Crush Saga shows the majority of that large batch of titles haven't helped with either monetization or public perception.

Farm Heroes Saga was the only non-Crush game to earn monetary mention in the first-quarter report. King wasn't specific with the numbers, but claimed that Farm Heroes was the reason the Candy Crush dependency fell that quarter. Bubble Witch Saga 2 has since widely released to Android and iOS operating systems, and sits among the top free downloads for both operating systems.

Popular games can further establish King's brand, regardless of the monetization potential. The company has a low-risk development process that can minimize the chance of a new game flopping after launch. King uses its royalgames.com website to test early, partial versions of games to gauge potential interest. Flubs can go out to pasture, while hits move up to full-stage development.

Monetization remains the key long-term concern for the most-played titles, as King needs to keep diminishing its Candy Crush dependence.

Organically improve monetization metrics

King's new deal with AppAttack to preinstall games onto select mobile devices has the potential to skew user metrics like monthly active users and monthly unique users because more people will take a game for a test run if it's already loaded onto the device. One key monetization metric won't suffer from this inflation: monthly active payers, or MUPs.

MUPs refers to the number of players who have made an in-game purchase during a specific month, with three months averaged in a quarterly report. The metric can't inflate with the pre-installations, since people just testing a game are unlikely to spend real money for the experience.

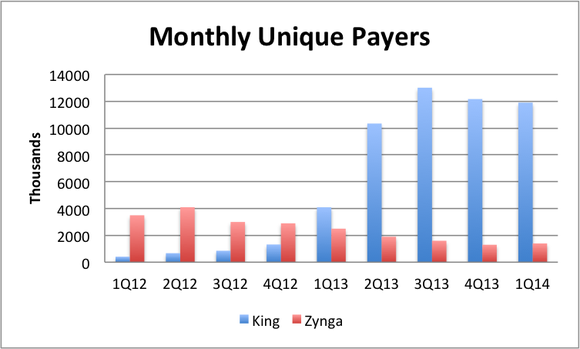

Here's a look at King's MUPs compared to Zynga:

Source: Company filings

The quick rise of King's MUPs tied directly to Candy Crush Saga's growing popularity -- and the drop toward the end coincided with a drop in Candy Crush players. Zynga has its own MUP problems, but its downward slope isn't as steep or threatened by one game.

King could turn the MUP issue around if Candy Crush Soda Saga achieves even a fraction of the popularity of its predecessor. Soda's heightened monetization options could also lead to the title becoming more profitable, even while attracting fewer players. Farm Heroes Saga could also continue its growth story, potentially with Bubble Witch Saga 2 right on its heels.

Foolish final thoughts

Zynga is expected to report second-quarter results later this month, and King is expected to follow with its own report in August. Game dependence and MUPs will provide the best health check for both companies. King needs to show a continued drop in Candy Crush dependence and some specific numbers on Farm Heroes Saga and Bubble Witch Saga 2 to demonstrate the monetization of those games. Candy Crush Soda Saga won't fully launch until fall, but has already racked up enough popularity that the game might provide earnings help by the third-quarter report.

Done playing Candy Crush? Your cable company is scared, but you can get rich

You know cable's going away. But do you know how to profit? There's $2.2 trillion out there to be had. Currently, cable grabs a big piece of it. That won't last. And when cable falters, three companies are poised to benefit. Click here for their names. Hint: They're not Netflix, Google, and Apple.

The article 3 Ways King Digital Entertainment Could Make a Comeback originally appeared on Fool.com.

Brandy Betz has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments