Filed under: Investing

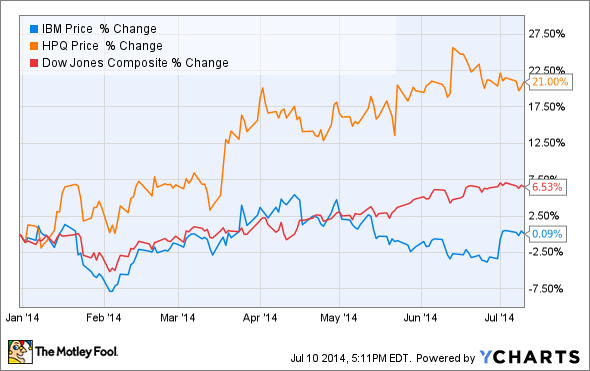

As it attempts to quell concerns over its seemingly stagnating revenue base, shares of IT "elephant" IBM have hung around breakeven so far in 2014, even as shares of other enterprise turnaround plays like Hewlett-Packard have soared.

IBM reports its Q2 earnings next week, and it appears investors are largely expecting more of the same from Big Blue.

IBM earnings: Can elephants still dance?

On average, analysts are calling for IBM to still be caught in the midst of the same slow-bleed revenue stagnation that's perhaps been the primary driver of its shares during the past several quarters. True to form, they also expect IBM's top-line woes to weigh on IBM's storied track records of bottom-line growth.

However, since this report will mark the halfway point before 2015, expect analysts to also shift their focus further out, and begin to asses whether it seems plausible that IBM will actually be able to hit its long-stated goal of $20.00 of operating EPS in the upcoming fiscal year.

And while IBM hitting its $20.00 OEPS metric certainly will matter to long-term investors, it's also hard to ignore that, like IT compatriot Hewlett-Packard, IBM remains dirt cheap. Investors (myself included) largely shunned Hewlett-Packard in late 2012 as it struggled to come to grips with the changing PC landscape, only to see its shares skyrocket since (and provide a useful lesson in long-term thinking). As tech and telecom specialist Andrew Tonner discusses in the video below, IBM's shares could also prove attractive today for investors willing to look past its current problems.

Top dividend stocks for the next decade

The smartest investors know that dividend stocks simply crush their non-dividend paying counterparts over the long term. That's beyond dispute. They also know that a well-constructed dividend portfolio creates wealth steadily, while still allowing you to sleep like a baby. Knowing how valuable such a portfolio might be, our top analysts put together a report on a group of high-yielding stocks that should be in any income investor's portfolio. To see our free report on these stocks, just click here now.

The article IBM Stock: Can Big Blue Beat Earnings This Week? originally appeared on Fool.com.

Andrew Tonner has no position in any stocks mentioned. The Motley Fool owns shares of International Business Machines. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments