Filed under: Investing

The U.S. Department of Energy estimates that by 2050, the world's population will reach 9.4 billion, and per capita income will double. This will result in a doubling of energy demand, and in an age of growing concerns over climate change, the world is increasingly looking to renewable energy to power the economies of the future.

In addition, according to the International Energy Agency (IEA), $2.55 trillion/year will have to be spent on global energy infrastructure and energy efficiency initiatives.

This presents a massive potential investment opportunity but also comes with many risks. This article will explore both to try to help long-term investors navigate these potentially lucrative, yet dangerous waters.

The coming green energy gold rush

According to the IEA's 2012 World Energy Outlook report, between 2012 and 2035, $6.4 trillion ($278 billion/year) will be spent on renewable energy as the share of electricity generated from environmentally-friendly sources nearly triples to 31%.

The three largest areas of investment will include wind power ($2.1 trillion), hydroelectric ($1.5 trillion), and solar photovoltaics ($1.3 trillion).

Source: SunEdison Capital Markets 2014 Investor Presentation

As the above chart from SunEdison Inc (a global manufacturer and retailer of solar panels) illustrates, the IEA's estimates may prove to be conservative, as global solar installations through 2020 are expected to be $1 trillion.

However, as the below chart shows, investing in renewable energy can be fraught with peril.

So let's take a look at the different ways investors can potentially profit from the green energy gold rush to see what is most likely to make long-term investors money.

ETFs

Guggenheim Solar ETF tracks the MAC global solar energy index and represents a concentrated portfolio of 26 solar panel manufactures. Its largest holdings include SunEdison, SolarCity , and First Solar Inc, which combined make up 22.5% of the portfolio. The expense ratio of 0.7% is higher than the category average of 0.65%, and potential investors should be aware of the 68% turnover ratio, which will generate higher tax liabilities and hurt long-term returns. In fact, over the last five years, the ETF has lost 12.3% of its return to taxes and generated a -10.41% annual return. Compare this to the S&P 500's 14.2% total return, and it looks even worse.

Another thing to consider is the ETF's extreme volatility, 153% that of the S&P 500.

First Trust NASDAQ Clean Edge US ETF has a below average expense ratio of 0.6% and represents a more diversified 50-company portfolio of U.S. clean energy companies. Its top three holdings include Tesla, First Solar, and Linear Technology Corporation, which makes integrated circuits and power management systems used in solar systems.

In addition to being more diversified than Guggenheim Solar, its turnover ratio is lower (49%) as is its volatility, with a beta of 1.5 indicating 50% higher volatility than S&P 500.

PowerShares WilderHill Clean Energy ETF consists of 57 clean energy companies with international exposure. Its top three holdings include Enphase Energy Inc, Daqo New Energy Corp, and Canadian Solar Inc.

Although this fund has an above-market-average yield of 1.96%, its 57% turnover ratio means 11.1% of its returns have been lost to taxes over the past five years.

First Trust Global Wind Energy ETF represents 49 international companies associated with every aspect of wind energy. Two benefits of this fund are that it represents a diversified yet pure play on wind energy, and it gives U.S. investors access to wind giants that aren't listed on U.S. exchanges. Examples of this include its three largest holdings, Iberdrola SA, a Spanish utility, China Longyuan Power Group, a Hong Kong based builder and operator of wind farms, and EDP Renovaveis, a Spanish utility that specializes in renewable energy.

In addition, unlike the other renewable energy ETFs, this fund has a longer-term approach with a turnover ratio of just 19%. and lower volatility with a beta of just 1.32.

Finally, Global X Lithium ETF is a way for investors to invest in the energy storage industry, which Lux research predicts will become a $50 billion annual market by 2020.

This fund represents a super-concentrated portfolio (80% of funds are in the top 10 holdings) including Rockwood Holdings, FMC Corporation, and Sociedad Quimica y Minera de Chile (Chemical and Mining Company of Chile). The fund focuses on the medium term with a 38.46% turnover rate, and a beta of 1.82.

The problem with ETFs

TAN Total Return Price data by YCharts.

The above chart illustrates just one of the many problems with renewable ETFs, mainly that they have massively underperformed the broader market over the last few years. Another problem with these ETFs is the high turnover rate, which investors have no say over. Here at The Motley Fool, we believe in long-term investing, and turnover rates of 50+% indicate the kind of short-term emphasis that not only results in higher tax costs, but also poorer long-term results.

The high betas and underperforming alphas of these ETFs shows that investors have a good chance of doing better selecting their own investments based on their individual time horizons and risk profiles.

So what about individual stocks?

I'm a firm believer that individual stocks, as part of a diversified portfolio, can not only outperform ETFs, but beat the market as well. When it comes to the renewable energy industry, there are three sectors I think are worth investing in: wind, solar, and hydroelectric power.

A popular solar stock -- but one to be skeptical about

SolarCity has an intriguing business model that promises to turn it into a solar utility. The company installs solar systems on customers' roofs (consumers can purchase the systems outright, but this is not what the business model is based on) at no cost in exchange for a 20-year contract. Thus each customer becomes a stream of long-term recurring revenue.

However, there are several things about the company's business model that concern me.

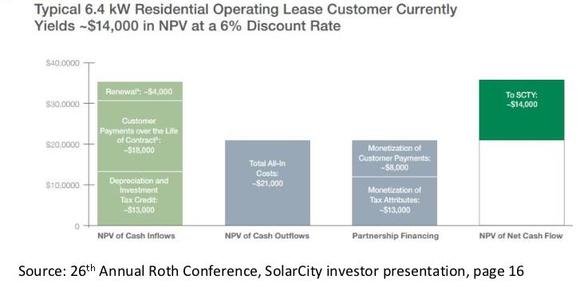

First, as this slide indicates, the typical solar city installation costs $21,000, 62% of which is covered by tax credits, which the company obtains from outside partners such as Google and US Bancorp through tax equity funds. Unfortunately, the tax credit is set to expire by the end of 2016, and should it not be renewed, that would greatly slow the company's plan to grow to 1 million customers by mid-2018 (they currently have 140,000).

The company has recently begun securitizing its solar projects (meaning selling bonds backed by the recurring revenues its panels bring in), which helps reduce its new cost of capital down to 4%. This provides a backup source of funding should the tax credit expire, but it also requires SolarCity to take on ever more debt. Given its recent acquisition of solar panel manufacturer Silevo, and its plans to build a new 1 GW factory (eventually SolarCity wants 10 GW of panel capacity), SolarCity will need enormous capital going forward. For example, it recently pledged $750 million to a Buffalo, NY factory that will have 200 MW of solar panel capacity.

That comes to $3.75 billion/GW of capacity, and given that the project is a joint venture with Soraa (a California LED maker) and the state of New York (which is contributing $225 million of the total $1.75 billion cost), it's not certain how much of that capacity SolarCity will have claim to.

With analysts expecting SolarCity to lose $734 million between in 2014 and 2015 before it announced the Silevo acquisition, and the company posting 12-month levered free cash flow of -$946 million, the company will likely have to issue a lot of debt and dilute existing shareholders through secondary offerings. This could hurt long-term returns, as I explained in a previous article outlining the six largest risk factors for SolarCity.

Bottom line

The renewable energy market represents a massive opportunity for long-term investors; however, it's an industry fraught with peril as well as much hype and speculation. Whether it's a clean tech ETF or a Wall Street darling like SolarCity, investors must always remain skeptical, carefully examine both the potential risks as well as possible rewards, and never forget the importance of proper diversification. That being said, a reasonable allocation to the industry is warranted, and with the right investments you can take a share of this global $6.4 trillion movement.

Do you know this energy tax "loophole"?

You already know record oil and natural gas production is changing the lives of millions of Americans. But what you probably haven't heard is that the IRS is encouraging investors to support our growing energy renaissance, offering you a tax loophole to invest in some of America's greatest energy companies. Take advantage of this profitable opportunity by grabbing your brand-new special report, "The IRS Is Daring You to Make This Investment Now!," and you'll learn about the simple strategy to take advantage of a little-known IRS rule. Don't miss out on advice that could help you cut taxes for decades to come. Click here to learn more.

The article What's the Best Way to Cash in on the $6.4 Trillion Renewable Energy Boom? originally appeared on Fool.com.

Adam Galas has no position in any stocks mentioned. The Motley Fool recommends SolarCity. The Motley Fool owns shares of SolarCity. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments