Filed under: Investing

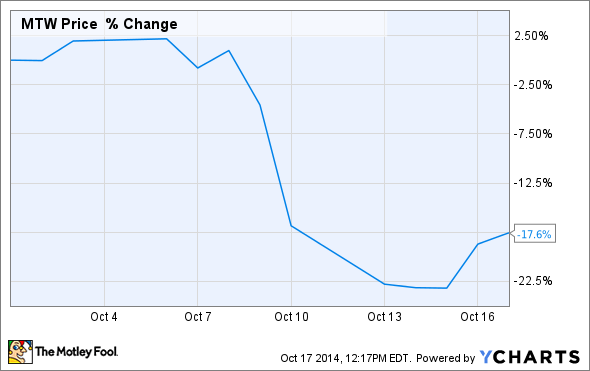

Let me confess: When I recently told investors why Manitowoc could fall, I didn't see this crash coming. The stock tanked 24% in four days after the crane maker revised its full-year earnings guidance downward last Friday.

But here's the interesting part: The stock's already back in action, having recovered nearly 7% as of this writing. Is this just a dead cat bounce, or is the weakness a temporary blip that truly represents an opportunity for investors? Let's find out.

The news that killed the stock

Here's how Manitowoc's revised 2014 guidance compares to its previous outlook:

|

Segment Metric |

Previous Projection |

Revised Projection |

|---|---|---|

|

Crane revenue |

Flat to slightly down |

Down mid-to-high single-digit % |

|

Crane operating margin |

High single-digit % |

7% |

|

Foodservice revenue |

Up mid single-digit % |

Up low-to-mid single-digit % |

|

Foodservice operating margin |

Mid-teens % |

15% |

Source: Manitowoc

- Its crane business is clearly under pressure, and a high-single-digit percentage drop would be alarming.

- Its foodservice-equipment business is relatively more stable, but is experiencing headwinds as evidenced by the slightly lower projected revenue.

- Its margin projections indicate a decline over last year - Manitowoc reported 8.7% and 16.2% operating margin for crane and foodservice businesses, respectively, in 2013. While lower crane margin is not surprising, the expected percentage drop in foodservice operating margin despite a growing top line is worth noting.

Let me first explain why Manitowoc lowered its outlook, and then tell you why the stock was really dumped, because there's more to the massive sell-off than meets the eye.

Why Manitowoc is feeling the heat

I explained in my last article how weak demand for off-road cranes is hurting Manitowoc, and negating strength in sales from the U.S. residential and commercial construction markets. The company confirmed it last week by highlighting how its crane sales were "affected by the North American rough-terrain and boom truck markets, as well as weakness in the Latin America region."

Manitowoc's first Latin American crane factory at Passo Fundo, Brazil started operations in 2012.

Unfortunately, the weakness could last longer than you think. Terex also slashed its full-year guidance last month, after its crane orders "dropped significantly in July and August." Terex further highlighted how "customers in developing markets are struggling to secure financing for orders scheduled for delivery in the second half of 2014." Consider that cranes are just one part of Terex's portfolio, contributing less than 30% to its total sales. So if Terex had to cut back its guidance almost entirely because of weakness in the cranes market, things must be pretty bad.

In fact, two of Manitowoc's key growth markets - China and Latin America - have hit roadblocks. Over the past year, Manitowoc not only sold half its stake in a five-year old joint venture with a Chinese company, but also exited its joint venture with China-based Shantui Investment. Let's not forget that officials in China aren't ruling out the possibility of a property bubble burst over the next couple of years. Meanwhile, the World Bank projects Latin America to grow only 1.2% this year - the slowest such pace since 2009. None of this bodes well for Manitowoc.

Why bears charged in

While weak guidance, especially for its crane business, was enough to send Manitowoc investors running for cover, I can think of three more reasons why the stock is under so much pressure:

Muted guidance for foodservice-equipment business: Manitowoc's foodservice business -- traditionally a high-margin business - delivered strong numbers through the first half this year, thus fueling investors' optimism about the company, and its stock. So Manitowoc's reduced foodservice revenue guidance probably didn't go down well with investors.

Split speculation gone wrong: This is perhaps the biggest reason why Manitowoc shares crashed. Ever since activist investor Relational Investors upped its stake in Manitowoc midway through this year in a bid to pressure management to separate the company into two, the market hasn't taken its eyes off the stock. The story has taken an interesting turn now - Relational Investors is winding down, and will likely offload its investments, which of course, includes its stake in Manitowoc. Naturally, the news left investors bitter.

Premium valuation: Before its precipitous fall, Manitowoc stock was trading at 28 times earnings - much costlier than most peer stocks. So for those who were concerned about its high valuation, the company's guidance downgrade was an excellent reason to take some profits off the table.

But does that mean Manitowoc stock is a better play than peers today? The table below could give us the answer.

|

Company |

Trailing P/E |

Forward P/E |

|---|---|---|

|

Manitowoc |

21 |

10.9 |

|

Caterpillar |

16 |

13.5 |

|

Terex |

9.1 |

8.9 |

|

Middleby |

26.2 |

20.2 |

Source: Yahoo! Finance

While Manitowoc certainly looks like a value buy compared to foodservice rival Middleby, it's still trading at a considerable premium to Caterpillar and Terex. But analysts are predicting a sharper recovery in Manitowoc's earnings going forward, as evidenced by the dramatic drop in its forward P/E. Part of it may have to do with the optimism about Manitowoc's resilient foodservice business. In contrast, Terex is purely a construction-equipment company and hence more vulnerable to economic slowdown, while Caterpillar has a lot at stake in the struggling mining industry.

So should you dive into Manitowoc now?

Given the ongoing weakness in key international crane markets, and the possibility that foodservice may grow at a muted pace at best, I'd not be too keen on Manitowoc right now. Remember that Manitowoc is also a heavily leveraged company that needs to grow its operating income and cash flows at a faster pace. A slowdown in any of its businesses is terrible news in such situations. I'd sit out the discount until the company confirms a turnaround in key markets.

Take advantage of this little-known tax "loophole"

Recent tax increases have affected nearly every American taxpayer. But with the right planning, you can take steps to take control of your taxes and potentially even lower your tax bill. In our brand-new special report "The IRS Is Daring You to Make This Investment Now!," you'll learn about the simple strategy to take advantage of a little-known IRS rule. Don't miss out on advice that could help you cut taxes for decades to come. Click here to learn more.

The article Manitowoc Company Inc. Stock Crashes 24% in 4 Trading Days: Is It Time to Buy? originally appeared on Fool.com.

Neha Chamaria has no position in any stocks mentioned. The Motley Fool recommends Middleby. The Motley Fool owns shares of Middleby. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments