Filed under: Credit, Credit Reports, Credit Score

-- U.S. Federal Trade Commission

Identity theft and credit card fraud are plagues upon the nation: After the recent data thefts at Target (TGT), eBay (EBAY) and Sony (SNE), it's unlikely anyone would argue otherwise.

The good news, though, is that if you think you might be the victim of credit fraud, and want to check your credit report to confirm that no one's been, say, opening credit card accounts in your name, the federal government has given you a way to do that free of charge. Once a year, you can hit up each of the three major credit bureaus for a free copy of your report. It's best to space out your requests to hit each company separately, and you can get one free report every four months.

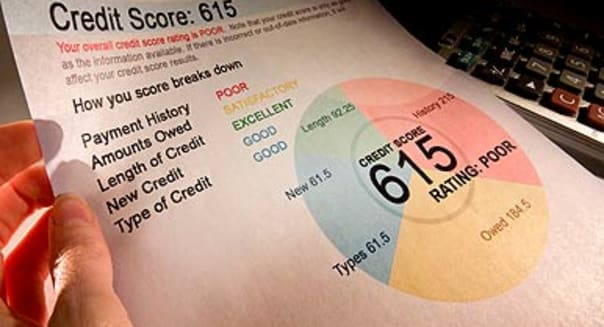

But what about the crown jewels of the credit reporting world? What if you don't just want copies of the raw data on your credit history, but also want a peek at your actual FICO credit score? That can be a problem. At least, unless you want to pay up for it.

Credit Scores? We Ain't Got (to Show You) Any Stinkin' Credit Scores

Equifax (EFX), Experian, and TransUnion spent a lot of time and money assembling your credit history. They spend more money hiring Fair Isaac (FICO) -- the company behind the FICO score -- to crunch the numbers and convert this raw data into an easy-to-use "credit score," which FICO provides each credit bureau in response to the data they send. FICO scores can differ among credit bureaus and differ over time, being generated by FICO in response to point-in-time requests for their generation from the respective bureaus. Also, not all "credit scores" are official FICO scores. According to Fair Isaac itself, when one of the credit bureaus sells you an official FICO score, it is called a "FICO Risk Score."

These companies make a lot of money selling this information -- both to companies that want to know if you're a good credit risk (TransUnion did more than $740 million in such business last year, according to S&P Capital IQ) and to consumers who are willing to pay to know their scores (Equifax's annual haul from its North America Personal Solutions business is $207 million). They're not going to give that kind of information away for free unless they have to. And so far, at least, the FTC isn't saying they have to.

Result: Historically, these companies have used credit scores as a marketing tool, bundling the price of a peek at your credit score with credit monitoring and identity theft protection services. For example, for $14.95 per month, Equifax will sign you up for constant monitoring of your official FICO score alone. For $15.95, they'll give you one-time access to your full credit report, plus an internally generated Equifax Credit Score (not the same as a FICO Risk Score -- see above). $19.95 a month will buy ongoing "premier" access to your Equifax Credit Score, credit report and ID theft monitoring. Like the super-size menu at McDonald's, you might have only wanted an order of fries, but Equifax hopes you'll pay a bit extra for a bigger bundle.

Pro tip: You can also get a one-time peek at your Equifax score while requesting your FTC-guaranteed once-a-year free credit report. In the signup process, Equifax will pitch you the option of adding your credit score for $7.95.)

The other two credit bureaus recently took a different tack. As of last month, both Experian and TransUnion have begun offering access to your credit score for just $1. TransUnion offers its internally generated TransUnion Credit Score, while Experian sells the official FICO score generated for it by Fair Isaac.

There is a string attached, of course. Both companies bundle the credit score peek with a "seven-day trial period" to their respective credit monitoring services. This seems like a better deal than, for example, the myFICO.com service from Fair Isaac, which locks you into a minimum three-month contract for credit monitoring (at $19.95 per month) if you want a peek at your FICO score. Note that myFICO will give you official FICO scores for all three credit bureaus.

Taking TransUnion or Experian up on their offer, however, does require vigilance on your part. Both companies will permit you to cancel your subscription within the seven-day free trial period, with no charges other than the initial $1. Forget to cancel, however, and Experian will begin billing you $21.95 monthly for Experian Credit Tracker, while TransUnion will sign you up for TransUnion Credit Monitoring at $17.95 per month.

The Upshot for Consumers

Now, there may well be value in these services. They may even be worth every penny. But savvy credit shoppers should also consider saving money with the following simple plan:

Step 1: Buy access to your official FICO credit score from Experian for $1. Since TransUnion and Experian charge the same $1, but only Experian provides an official FICO score, it appears to offer more value for the money. Cancel immediately after. Experian tells me via email that they'll permit you to repeat this trial offer twice a year.

Step 2: Take a good hard look at the credit report, too. It's free for the seven days, so why not?

Step 3: Keep up to date on changes in your credit report by staggering requests for your FTC-guaranteed credit reports throughout the year. For example, hit up Experian in January, TransUnion in May, and Equifax in September -- once a year, every year.

Step 4: In between times for those free official reports, use a free credit monitoring service such as CreditKarma.com or CreditSesame.com. Both services will also give you their best guesses at your probable credit score, and Credit Sesame will throw in $50,000 worth of "identity theft insurance and ID restoration help" -- also for free.

A strong believer in practicing what he preaches, Motley Fool contributor Rich Smith has requested his own Equifax credit report. As for stock disclosures, he has no position in any stocks mentioned. The Motley Fool, however, recommends and owns shares of eBay. Try any of our Foolish newsletter services free for 30 days. Want to make 2015 a winning investment year? Check out The Motley Fool's one great stock to buy for 2015 and beyond.