Filed under: Company News, Retail, Market News, Wal-Mart, Investing

The result is a retailer that's stuck in a rut with deteriorating financials. The long history of failed retailers from Woolworth to Montgomery Ward to Sears (SHLD) tells us that a retailer's time on the top of the industry rarely lasts long. For Walmart, this may be the beginning of the end.

Slow Growth in the U.S.

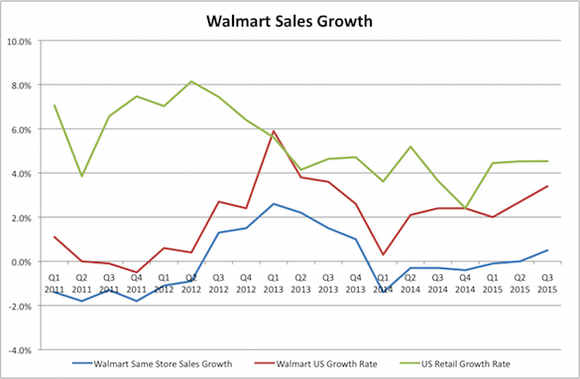

For any retailer, the goal is to build stores that will grow their own sales year after year while simultaneously expanding your footprint into more markets. So, to measure a retailer's success we need to look at its overall growth rate and same-store sales growth to see how it's doing on a store level. On both fronts, Walmart is struggling.

In only one of the last 19 quarters did Walmart grow its overall U.S. sales as fast as overall U.S. retail sales grew. On a same-store level, Walmart actually saw sales fall between the beginning of 2009 and today. That's terrible, because in that time frame the economy has been recovering and people have steadily been spending more at retailers.

Oddly enough, the U.S. is actually Walmart's best operating region. International expansion has run into a number of roadblocks that have caused management to rethink how much it wants to spend overseas.

Failures Overseas

You might think that growing overseas should be easy for a retailer. Put up new stores, build out the distribution network, sign up most of the same suppliers that made your U.S. operations a success, and you're ready to go. But in reality, it isn't nearly that simple.

There are a number of cultural differences retailers have found challenging internationally, from local shopping habits (e.g., customers stopping by a local shop daily) to brand preferences. Compounding the problem is the fact that distribution networks often operate differently depending on the country's infrastructure. Things as simple as road conditions alone can make it difficult to deliver product to stores in a timely manner for a retailer like Walmart.

The company has already sold or ended ventures in Germany and South Korea. In India it had to buy out a local partner in 2013 after six years of struggles, taking control of a small 20-store wholesale operation in the world's second-most-populous country. It has also run into problems with mislabeled meat in China and disappointing profits in Brazil, and it chose to sell its 360 Vips restaurants in Mexico. The result of these failures on the company's financials is dramatic. (Walmart's fiscal year ended on Jan. 31, and its next quarterly report is due Feb. 19.)

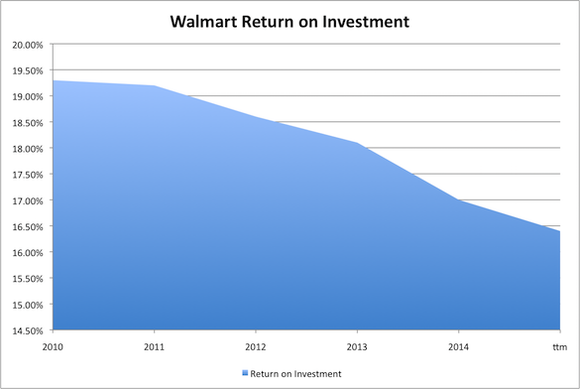

Walmart's Finances Are Deteriorating Fast

One way Walmart wants to measure its own success is by a metric called return on investment. This is basically the profit made on each dollar you invest in growing a business, like building a new store. It's through return on investment that we can see the dramatic decline in Walmart's operations. You can see below that it's been in deteriorating steadily since 2010 and shows no sign of slowing down.

Who Is Taking Over the Reins of Retail?

If Walmart is struggling, who is winning in retail today? If you go to any mall in the U.S. you'll see a very different scene than you did even a decade ago. Malls are no longer filled with department stores or specialized retailers -- they're filled with brand stores themselves. Nike (NKE), Puma, Apple (AAPL), Microsoft (MSFT) and Oakley are just a few of the brands that now operate their own stores, competing directly with retailers like Walmart that also sell their goods.

But there's a key difference between the brand retail stores and traditional retailers: Brands don't necessarily care if you make a purchase at their store today or go online and buy something from a different retailer -- they're getting the sale either way. For Walmart, if you're "window shopping" at their stores and buy online from Amazon, it's a lost sale.

I think the next major consumer trend will be not just buying online but buying from brand retailers themselves. This is already prevalent, but I think it will grow in popularity as free shipping offers improve and brands choose to keep key product launches in-house. Nike is a leader in this, introducing key products like the Jordan line online at its own site, drumming up business that would have been done at a retailer previously.

Given the loss of market share in the U.S., lagging profits internationally, and general retail trends moving away from Walmart, I think the company is in for a long and slow decline. The company is in worse shape than you might think, and there isn't a quick fix for a behemoth that's simply gone out of style.

Motley Fool contributor Travis Hoium owns shares of Apple. The Motley Fool recommends Amazon.com, Apple and Nike. The Motley Fool owns shares of Amazon.com, Apple, Microsoft, and Nike. Try any of our Foolish newsletter services free for 30 days. To read about our favorite high-yielding dividend stocks for any investor, check out our free report.