Filed under: Taxes, Government Spending, Income Tax, State Income Tax

That day of tax freedom is 114 days into 2015, one day later than last year, the Washington-based Tax Foundation announced Tuesday.

If working the first third of the year just to pay federal, state and local taxes isn't depressing enough, here's another fun fact: Americans will collectively spend more on taxes in 2015 than they will on food, clothing and housing combined. Read that again. The basic necessities of life this year will cost less than the average tax bill.

Americans will pay $3.28 trillion in federal taxes in 2015, and $1.57 trillion in state and local taxes, for a combined tax bill of $4.85 trillion, or 31 percent of the nation's income. It will take Americans 43 days to pay those income taxes, followed by 26 days to pay payroll taxes, 15 days for sales and excise taxes, 12 days for corporate income taxes, 11 days for property taxes and the remaining seven days for estate and inheritance taxes, custom duties and other taxes.

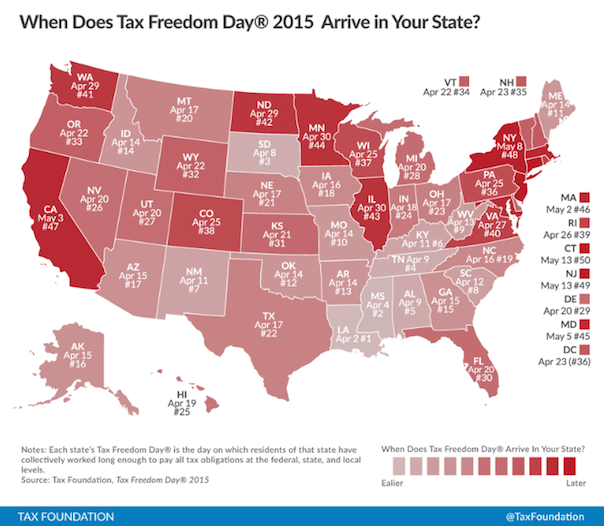

Across the country, Tax Freedom Day depends on your state's tax laws. Connecticut and New Jersey have the latest freedom date -- May 13 -- preceded by New York on May 8. Louisiana has the lowest average tax burden, with its residents gaining tax freedom on April 2. Other early arrivals are Mississippi on April 4 and South Dakota on April 8.

Tax Freedom Day is a day later this year mainly because of the country's steady economic growth, according to the foundation, which calls itself a nonpartisan research think tank. Higher wages and corporate profits are expected to boost tax revenue.

The good news is that Tax Freedom Day in 2015 isn't the latest date among previous days of tax freedom. That distinction goes to the year 2000, when it was on May 1 and Americans paid 33 percent of their total income in taxes.

In 1900, Americans paid 5.9 percent of their income in taxes, when Tax Freedom Day came on Jan. 22. The last time Tax Freedom Day was this late in the year was 2007 when it was held on April 25.

At Least the Deficit Is Dropping

If annual federal borrowing is included, which represents future taxes owed, Tax Freedom Day is 14 days later this year -- May 8.

Federal expenses have surpassed federal revenues since 2002, with the budget deficit exceeding $1 trillion annually from 2009 to 2012, and more than $800 billion in 2013, according to the foundation.

The deficit is on track to decline in 2015, to $580 billion. Including federal borrowing results in a later Tax Freedom Day, but the good news is that the country's deficit is dropping. That may be the best news since the latest deficit-inclusive Tax Freedom Day -- May 25, 1945.