A New Beginning for WWE ®

STAMFORD, Conn.--(BUSINESS WIRE)-- WWE today opened its world-class training facility that is the new foundation for WWE's guaranteed success. As the new home to WWE's talent developmental system, NXT®, the new facility in Orlando, Florida was officially unveiled at a press conference hosted by Paul "Triple H®" Levesque, Executive Vice President, Talent and Live Events, WWE, Stephanie McMahon, Executive Vice President, Creative, WWE, Florida Governor Rick Scott, Mayor of Orange County Teresa Jacobs and Ken Goldstone, Chief Operating Officer, Full Sail University.

![WWE SVP of Special Events, John P. Saboor, Full Sail University COO Ken Goldstone, Orange County Com ...]()

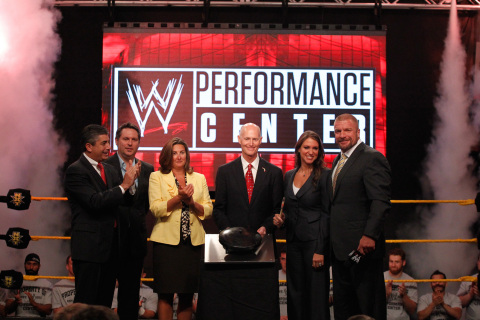

WWE SVP of Special Events, John P. Saboor, Full Sail University COO Ken Goldstone, Orange County Commissioner Jennifer Thompson, Governor Rick Scott, WWE EVP of Creative Stephanie McMahon and WWE EVP of Talent and Live Events Paul "Triple H" Levesque ring the bell at the grand opening of the WWE Performance Center in Orlando, FL on July 11, 2013. (Photo: Business Wire)

With 26,000 square-feet, seven training rings, a world-class strength and conditioning program and cutting-edge edit and production facilities, the new state-of-the-art Performance Center will give WWE the ability to train more potential performers than ever before through a comprehensive program including in-ring training, physical preparedness and character development.

"The WWE Performance Center represents the guaranteed future success of our company, providing the next generation of WWE Superstars with a world-class facility to call their own," said Paul "Triple H®" Levesque, Executive Vice President, Talent and Live Events, WWE. "The venue offers our developmental talent a full training experience with real time feedback from WWE coaches, trainers and doctors, giving them the resources they need to develop their talent both athletically and creatively."

"We are happy to be back here at WWE's Global Performance Center, officially opening this state-of-the-art training facility," said Governor Rick Scott. "WWE is a big name in sports entertainment so it's fitting that they have chosen to take a one-way ticket to Florida to grow their business. In only two and a half years, Florida has created 330,000 private-sector jobs and our unemployment rate has dropped well below the national average to 7.1 percent. It's working in Florida."

"Creating new, high-value jobs has been a top priority for my administration since day one. The grand opening of the amazing WWE Performance Center is terrific news for our local economy," said Teresa Jacobs, Orange County Mayor. "Not only are these great jobs, the presence of the WWE Performance Center adds to Central Florida's reputation as a television, film and entertainment production hub."

"Throughout our evolving partnership with WWE, our students have had the unique educational opportunity to take part in the live production process for WWE NXT tapings within the Full Sail Live venue," said Ken Goldstone, Chief Operating Officer for Full Sail University. "We are delighted to have the WWE Performance Center in such close proximity to our campus, and we are proud to participate in welcoming this facility to Central Florida."

The new center will be the training ground for approximately 75 talent who include former professional and collegiate athletes, Olympians and entertainers, offering a best-in-class sports medicine program and a central location for all current WWE Superstars to receive the best care both in and out of the ring.

WWE Performance Center Key Highlights:

In-Ring Training Room

- 12,000 square-foot world-class training room with seven training rings

- Including one "show ring" with theatrical lighting and broadcast capability to provide developmental talent with a full training experience

- Connectivity between the Performance Center and WWE's headquarters in Stamford, Conn., via closed circuit cameras will allow for real time feedback from WWE executives

Sports Medicine/Rehabilitation

- Best-in-class sports medicine facility with on-site medical care creating a central location for all WWE talent to receive the best care both in and out of the ring

- Dr. Michael Sampson, Medical Director, holds regular office hours

- Access to a full-time athletic trainer and full-time physical therapist whenever talent are training as well as a network of local specialists

Strength and Conditioning

- 5,500 square-foot state-of-the-art strength and conditioning room that will allow for daily training sessions for all developmental trainees

- Featuring cutting edge strength and conditioning equipment, cardio machines, medical rehab equipment and floor space for stretching and plyometric movement

- World-renowned strength coach Joe DeFranco will serve as a consultant

Promo Room

- A small, private studio that allows talent to practice on-camera techniques and work individually on character development and performance skills

- Capable of being operated by the talent themselves, this one-of-a-kind studio functions without technical personnel and is controlled using a simple iPad interface

Edit and Production Suites

- Cutting-edge edit and production facilities dedicated to creating improved TV performances for in-ring talent

- Flash (Pre-tape) Studio - a full-function, green-screen capable studio designed to allow talent to practice their TV presentation skills or to create content for NXT or WWE programming. The room features a Sony ENG style camera, studio lighting and high-resolution recording using AJA Digital recording hardware operated by production staff

- VO Booth - a practice room designed for announcers-in-training to work with WWE seasoned professionals to hone their live action announcing and play-by-play skills. The room allows for up to three announcers to work directly with an audio engineer to provide quick and easy record and playback functionality

The Performance Center solidifies WWE's presence in Orlando and evolves WWE's partnership with Full Sail University. Last year, WWE and Full Sail announced an innovative partnership that moved live tapings of WWENXT series, WWE's weekly one-hour show that broadcasts on Hulu Plus and in more than 100 countries, to Full Sail Live, the university's state-of-the-art performance venue. The partnership, which created a student scholarship fund, also allows students of the university's entertainment-focused degree programs, including Film, Show Production, Digital Arts and Design, Internet Marketing and Entertainment Business, to gain real-world experience alongside WWE production staff during WWE NXT tapings.

For more information about NXT and talent bios, visit http://www.wwe.com/shows/wwenxt.

About WWE

WWE, a publicly traded company (NYS: WWE) , is an integrated media organization and recognized leader in global entertainment. The company consists of a portfolio of businesses that create and deliver original content 52 weeks a year to a global audience. WWE is committed to family friendly entertainment on its television programming, pay-per-view, digital media and publishing platforms. WWE programming is broadcast in more than 150 countries and 30 languages and reaches more than 650 million homes worldwide. The company is headquartered in Stamford, Conn., with offices in New York, Los Angeles, London, Miami, Mumbai, Shanghai, Singapore, Istanbul and Tokyo.

Additional information on WWE (NYS: WWE) can be found at wwe.com and corporate.wwe.com. For information on our global activities, go to http://www.wwe.com/worldwide/.

Trademarks: All WWE programming, talent names, images, likenesses, slogans, wrestling moves, trademarks, logos and copyrights are the exclusive property of WWE and its subsidiaries. All other trademarks, logos and copyrights are the property of their respective owners.

Forward-Looking Statements: This news release contains forward-looking statements pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995, which are subject to various risks and uncertainties. These risks and uncertainties include, without limitation, risks relating to maintaining and renewing key agreements, including television and pay-per-view programming distribution agreements; the need for continually developing creative and entertaining programming; the continued importance of key performers and the services of Vincent McMahon; the conditions of the markets in which we compete and acceptance of the Company's brands, media and merchandise within those markets; our exposure to bad debt risk; uncertainties relating to regulatory and litigation matters; risks resulting from the highly competitive nature of our markets; uncertainties associated with international markets; the importance of protecting our intellectual property and complying with the intellectual property rights of others; risks associated with producing and travelling to and from our large live events, both domestically and internationally; the risk of accidents or injuries during our physically demanding events; risks relating to our film business; risks relating to increasing content production for distribution on various platforms, including the potential creation of a WWE network; risks relating to our computer systems and online operations; risks relating to the large number of shares of common stock controlled by members of the McMahon family and the possibility of the sale of their stock by the McMahons or the perception of the possibility of such sales; the relatively small public float of our stock; and other risks and factors set forth from time to time in Company filings with the Securities and Exchange Commission. Actual results could differ materially from those currently expected or anticipated. In addition, our dividend is dependent on a number of factors, including, among other things, our liquidity and historical and projected cash flow, strategic plan (including alternative uses of capital), our financial results and condition, contractual and legal restrictions on the payment of dividends, general economic and competitive conditions and such other factors as our Board of Directors may consider relevant.

![]()

Photos/Multimedia Gallery Available: http://www.businesswire.com/multimedia/home/20130711006423/en/

Media Contact :

WWE

Matthew Altman, 203-352-1177

Matthew.Altman@wwecorp.com

or

Investor Contact:

WWE

Michael Weitz, 203-352-8642

Michael.Weitz@wwecorp.com

KEYWORDS: United States North America Connecticut Florida

INDUSTRY KEYWORDS: